SINGAPORE: About two in three Singapore residents aim to be free from financial worries when they are aged between 40 and 60, according to a survey by CIMB Singapore.

More than half – or 52 per cent of the respondents – also said they believe they need more than S$1 million to achieve financial independence.

In a report released on Tuesday (Apr 8), CIMB noted that despite this large sum, 72 per cent of those surveyed believe financial independence is a realistic goal, while 43 per cent of them were confident of managing their finances to achieve this.

But respondents cited the high cost of living, family responsibilities and low income as the top three barriers to reaching this goal.

Mr Raymond Tan, head of wealth management and preferred banking at CIMB Singapore, said that while having S$1 million in order to be financially independent is a realistic goal, it also depends on the various obligations that people have, such as supporting their children.

He also stressed the need to “adopt proactive strategies” to navigate barriers and potentially unforeseen financial challenges.

“So, you need to balance this need for protection versus the need to start to grow your investments. And really take advantage of compound growth starting early, building that savings habit,” Mr Tan said.

“It’s a learning process – so you typically start by going into lower-risk, lower-yielding investments and then as you build the experience and the confidence, you can start to move into riskier assets which offer potentially higher returns.”

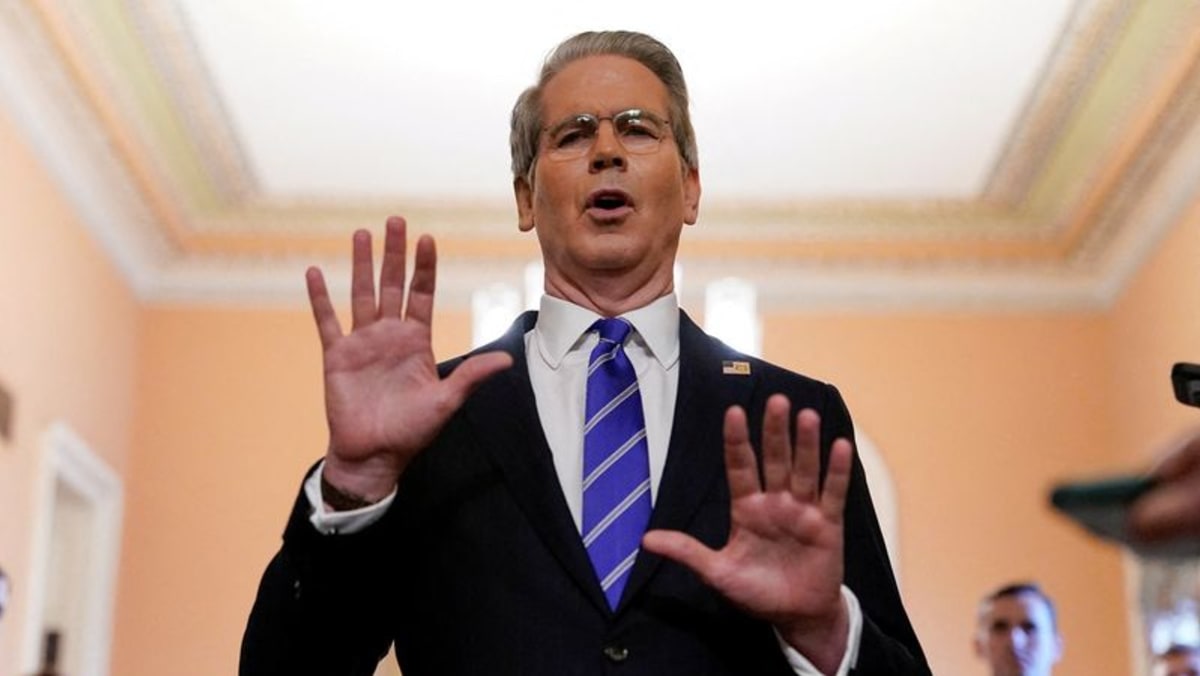

Mr Alvin Tan, Minister of State for Trade and Industry, said on Saturday that Singapore must be able to create good jobs for its people and stay resilient in a changing world.

“At the same time, we need to equip our people, particularly our youths, our mid-career (workers) and even our seniors who want to have jobs to make sure that they are upskilled,” he said during a fireside chat with CIMB Singapore CEO Victor Lee at the bank’s InsureXpo event.

Mr Tan made reference to FIRE (Financial Independence, Retire Early) – a personal finance movement defined by frugality, extreme savings and investment.

“If I were to introduce one more concept for people to think about … we continue to want to pursue financial independence, but in Singapore’s terms, given the challenges that we’re facing, can I also say that the ‘Retire Early’ – we also think about ‘R’ and ‘E’ as to build resilience and exceptionalism,” he added.