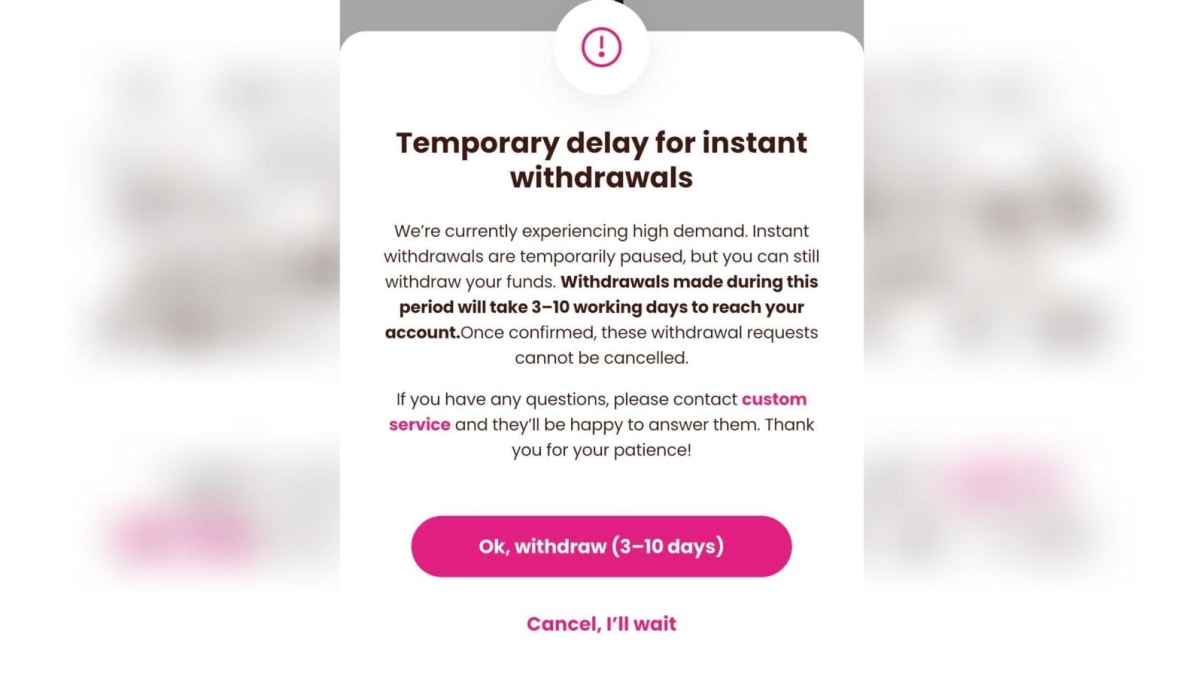

SINGAPORE: Chocolate Finance has temporarily suspended instant fund withdrawals due to “high demand”, it said in a notice to customers on Monday (Mar 10).

The financial services platform said that withdrawals will now take three to 10 working days before they are reflected in users’ bank accounts. Such withdrawal requests also cannot be cancelled once confirmed.

The suspension comes after personal finance influencer Seth Wee, better known as Sethisfy, uploaded a YouTube video on Sunday explaining his decision to withdraw all his money from Chocolate Finance. One reason he gave was the company’s removal of support for AXS payments.

The founder of travel website The MileLion, Aaron Wong, had also flagged the removal on Mar 5, with both posts making the rounds on Reddit and HardwareZone forum.

Mr Wee and Mr Wong both highlighted that Chocolate Finance’s initial statement seemed to suggest that AXS had decided to stop accepting the firm’s debit card. However, AXS later clarified that Chocolate Finance had requested the removal.

Chocolate Finance started working with AXS on Feb 11 and removed its Visa debit card, which touts zero foreign exchange (FX) market fees among its offerings, from the payment platform on Mar 5.

Finance blogger Dawn Cher, also known as SG Budget Babe, also shared in an Instagram story post that she had received a separate letter from Chocolate Finance, which attributed the increase in withdrawals to being “partly driven by social media”.

COMMUNICATED CHANGE “POORLY”

It started when the company launched a partnership that allowed customers to earn two miles per dollar on all spending, including usually excluded categories such as education fees, bills and AXS payments.

Chocolate Finance founder Walter de Oude said bill payments, especially through AXS, surged “far beyond expectations” and made the partnership “unsustainable”.

He said the company asked AXS to disable the Chocolate card instead of blocking bill payments entirely, and that the move “ensured the programme’s goal of balanced rewards”.

“But it happened so fast (that) we communicated this change poorly,” Mr de Oude said in a LinkedIn post.

Chocolate Finance initially “mistakenly implied AXS initiated the change”, though he said it was quickly corrected.

Customers using AXS were frustrated by the sudden removal, and this led to negative reviews, increased withdrawals and overall negative sentiment, he said.

Mr de Oude agreed in the same post that communications need to be well timed, relevant and detailed.

“I’ve also learned that offering a freebie that you know to be unsustainable is not a great way to build long-term trust and relationships,” he said, adding that Chocolate Finance will be stronger after learning from this mistake.

The company said in a statement on Monday afternoon that Chocolate Finance remains a “strong and stable place for your spare cash” and that it is “here for the long run”.

It said transparency and customer service are its “top priorities”.

INSTANT WITHDRAWALS

In their website FAQs, Chocolate Finance previously allowed up to S$20,000 in instant withdrawals per day due to its “Chocolate Liquidity Programme”.

It said that any money that is deposited into its account is invested in a portfolio of fixed-income funds designed to optimise returns.

But as the platform recognises the importance of liquidity, it added that the programme is an “awesome incentive”, giving its customers instant access to their money.

The company said on Monday that fund managers typically do not offer instant withdrawals, and Chocolate is returning to the “standard fund redemption process” due to the temporary surge in withdrawals.

“This pause is not a liquidity issue but a matter of managing our increased transaction volume,” said Chocolate Finance, adding that card transactions are also temporarily paused.

Chocolate Finance said it is actively implementing measures to manage increased transaction volume and to expedite the return to normal service.

WHAT IS CHOCOLATE FINANCE?

Chocolate Finance was founded last year by Mr de Oude, who also founded insurer Singlife. It is a brand under Chocfin, a capital market services licence holder regulated by the Monetary Authority of Singapore.

According to its website, funds with Chocolate Finance are held separately by custodians, including HSBC, and are not covered by the Singapore Deposit Insurance Corporation as it is not a bank.

When it launched, its higher than average cash returns – 3.3 per cent per annum on the first S$20,000 deposited, 3 per cent per annum on the next S$30,000 and a target of 3 per cent per annum above that – created some buzz among investors.

“We take no fee and make no money until we deliver the target returns,” Chocolate Finance said.

It also promised to offer even better cash returns for those parking United States dollars – a future offering promised 4.6 per cent per annum on the first US$20,000 deposited and 4.2 per cent for the next US$30,000.

These targets are, however, subjected to change based on market conditions, according to Chocolate Finance.