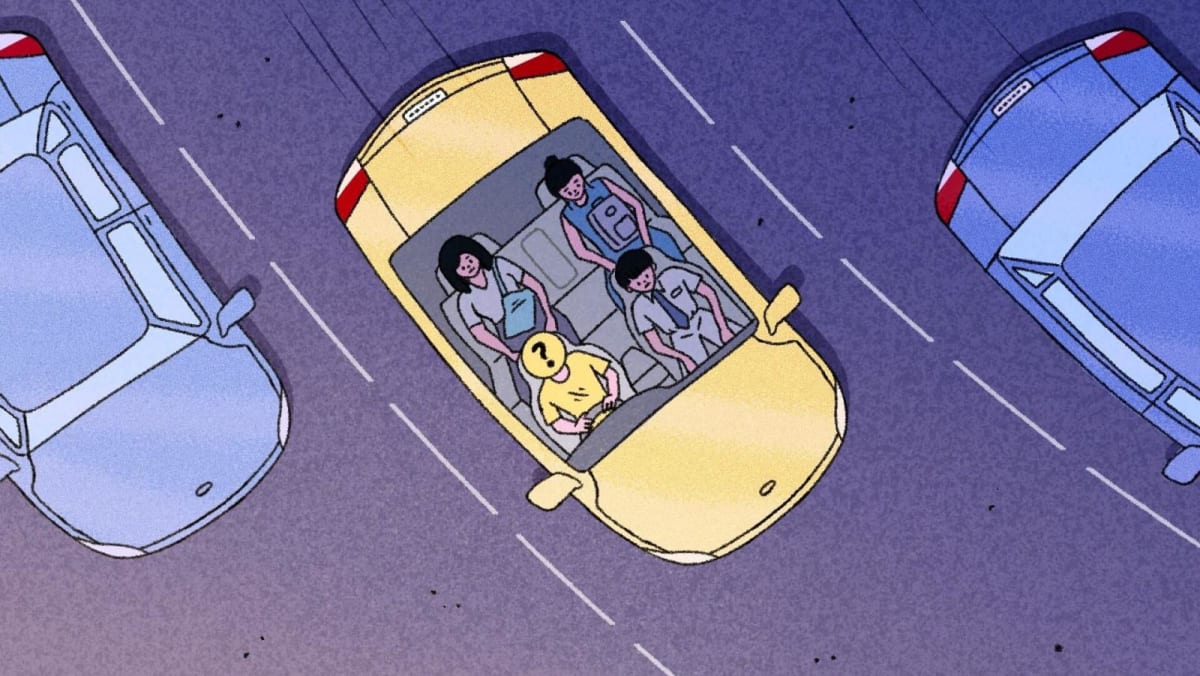

Private-hire car driver Mohammad Fadli typically knocks off work at around 4am after a six-hour shift.

By 7am, the 43-year-old is back on the road for another six hours, fetching people to their workplaces all across Singapore until the early afternoon.

The morning peak-hour crowds yield the most gains for Mr Fadli, so he never misses them. However, such 12-hour work days were not always the norm.

Driving for about 10 hours a day would have been enough for him to comfortably provide for his family just three years ago.

Now, even with his extended hours, he does not always earn enough to keep up with his family’s expenses.

As a result, he had to take up three loans over the past two years to pay the loan instalments for his car, as well as for his family bills and day-to-day expenses.

“I have four kids and they are all still living with me,” he said.

For eight quarters since January 2023, the proportion of platform workers – private-hire drivers and delivery riders – who applied for personal loans due to cost-of-living pressures had risen by 12 per cent.

This was from a report published last Monday (Mar 10) by Lendela, a financial technology site that matches borrowers with personalised loan options from various financial institutions.

Lendela did not provide absolute figures, saying that it was because of commercial sensitivities.

Its Singapore country manager Bryan Tay said that its data was based on a sample of about 15,000 platform workers’ applications to its site from the first quarter of 2023 to the fourth quarter of 2024.

The report also found that debt consolidation was the most common purpose for private-hire drivers (36.7 per cent) and delivery riders (34.1 per cent) in Singapore to apply for a loan.

For Mr Fadli, his loans came from ride-hailing firm Grab’s financing programme. Launched in 2023, the Partner Cash Advance programme provides loans of up to S$10,000 for private-hire drivers and delivery riders under Grab’s platform.

The programme is open to active driver and delivery-partners who have driven with Grab for at least three months, have average monthly earnings of at least S$1,000 and have met Grab’s internal credit risk assessments.

Mr Fadli has taken three loans under the programme, ranging from S$3,000 to S$6,000, on separate occasions. He has since paid them off, he said.

His situation is far from rare, based on conversations that CNA TODAY had with nine platform workers.

Mr Chris Tan, a 54-year-old private-hire driver, said that he knows “many” gig workers who have taken loans – either from Grab or other legal moneylenders – to help sustain their living expenses.

“I cannot take out loans because I have a bad credit score. But if I could, I would,” he admitted.

Credit Counselling Singapore – a non-profit that helps debt-distressed people through counselling, education and facilitating repayment arrangements – told CNA TODAY that it has seen fluctuations in the number of platform workers approaching it for help in recent years.

In 2022, it served 128 of these workers. This went down to 102 in 2023, before rising to 143 last year.

The most common reason given by these workers for getting into debt was a drop in their total household income.

The struggle to cover recurring bills was common among the workers, who are increasingly viewing loans as a necessity to tide through financially tough periods.

Mr Tan the private-hire driver is a single-parent with two children who are still studying in a secondary school and polytechnic.

He noted that fuel prices have almost doubled from a decade ago and the price of car rentals and daily necessities have increased, while his monthly income has not made equal gains despite him putting more hours on the road.

“Everything is rising, but the money I make is dropping.”