HONG KONG: Asian markets battled on Tuesday (Apr 8) to recover from the previous day’s tariff-fuelled collapse, though Donald Trump’s warning of more measures against China and Beijing’s vow to fight “to the end” raised concerns the trade war could worsen.

Equities across the world have been hammered since the US president unveiled sweeping levies against friend and foe, upending trading norms, sparking talk of a global recession and wiping trillions of company valuations.

Investors fought to claw back some of those losses as they try to assess the possibility that Washington could temper some of the tariffs. Tokyo traded up more than 6 per cent – recovering much of Monday’s drop – after Japanese Prime Minister Shigeru Ishiba held talks with Trump.

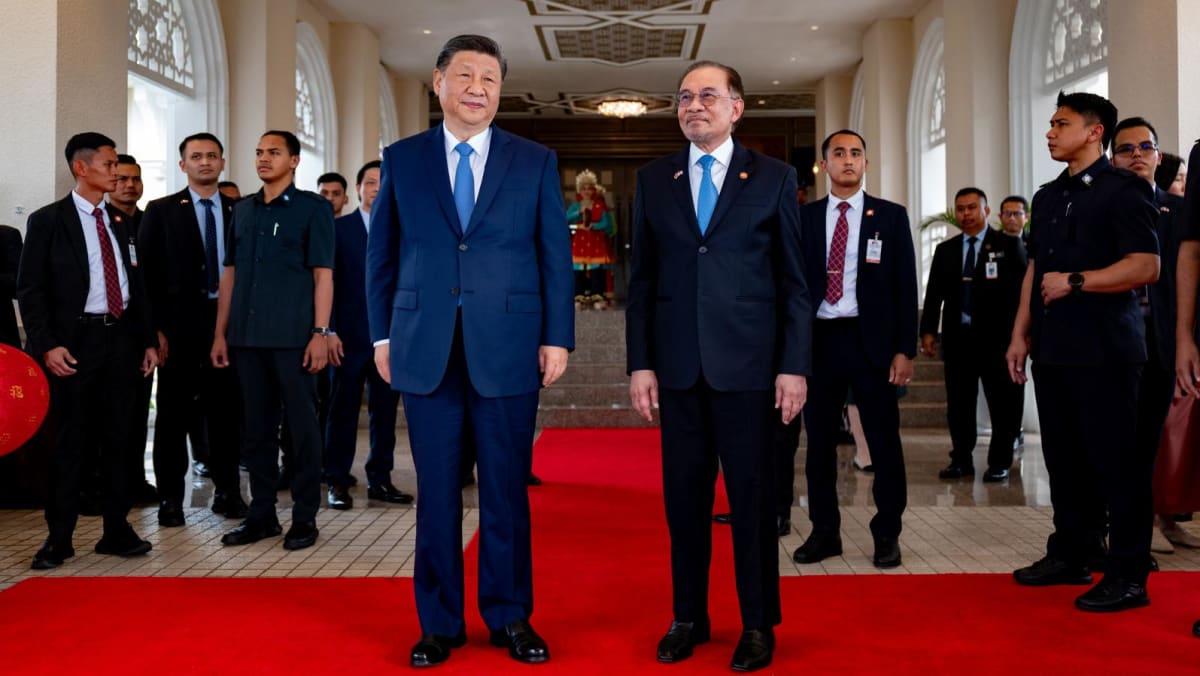

However, the US leader’s threat to hit China with an extra 50 per cent tariffs – in response to its 34 per cent retaliation in kind – ramped up the chances of a catastrophic stand-off between the two economic superpowers.

Trump said he would impose the additional levies if Beijing did not heed his warning not to push back against his barrage of tariffs.

China fired back that it would “never accept” such a move and called the potential escalation “a mistake on top of a mistake”.

“If the US insists on going its own way, China will fight it to the end,” a spokesperson for Beijing’s commerce ministry said on Tuesday.

In light of the turmoil gripping markets, Trump told Americans to “be strong, courageous, and patient”.

While uncertainty rules, investors in most markets took the opportunity to pick up some beaten-down stocks.

In Tokyo, Nippon Steel piled on around 11 per cent after Trump launched a review of its proposed takeover of US Steel that was blocked by his predecessor Joe Biden.

Hong Kong gained more than 2 per cent but was well off recouping Monday’s loss of more than 13 per cent that was the biggest one-day retreat since 1997. Sydney, Seoul, Wellington and Manila also rose.

Shanghai was also up on Tuesday after China’s central bank promised to back major state-backed fund Central Huijin Investment in a bid to maintain “the smooth operation of the capital market”.

The advance followed a less painful day on Wall Street, where the S&P and Dow fell but pared earlier losses, while the Nasdaq edged up.

Oil prices also enjoyed some respite, gaining more than 1 per cent.

Others however were not as fortunate. Taipei shed more than 4 per cent to extend the previous day’s record loss of 9.7 per cent, while Singapore also suffered further selling.

Trading in Jakarta was suspended soon after the open as it plunged more than 9 per cent as investors returned from an extended holiday, while the bourse in Vietnam – which has been hit with 46 per cent tariffs – shed 5 per cent.