MUMBAI :Indian non-banking finance company Shriram Finance is mulling raising funds denominated in Japanese yen to diversify its borrowing profile, with talks still in preliminary stages, its CEO said on Monday.

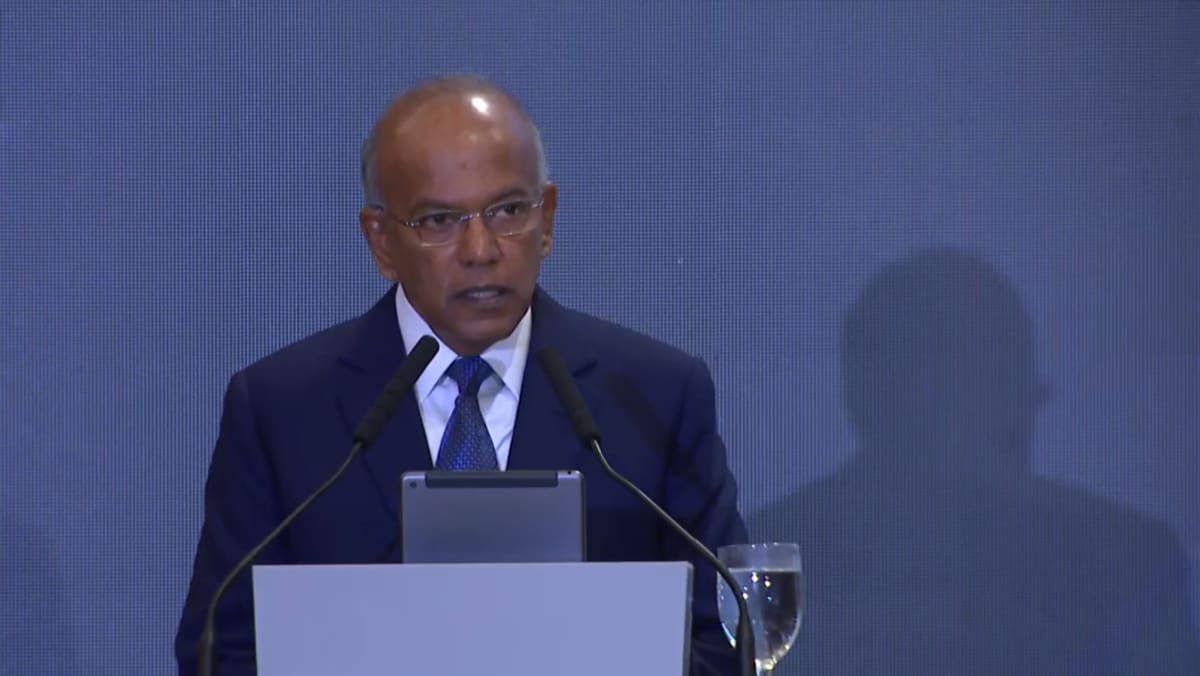

“Our team is exploring a possibility if we can borrow from the Japanese (currency),” YS Chakravarti told Reuters in an interview. “This could be either from a bank or an international bond issue, which corporates can subscribe to.”

Shriram Finance is “still exploring the market”, Chakravarti said, without divulging the target or timing of the fundraise.

External commercial borrowing loans made up nearly 15 per cent of Shriram’s total borrowing profile as of March-end, while overseas bonds comprised about 6.8 per cent.

In December, the NBFC raised $1.28 billion in a multi-currency social loan split across the dollar, euro and dirham, with a tenor of up to five years.

On Friday, Shriram Finance reported a smaller-than-expected fourth-quarter profit as high finance costs pressured its bottom line. The company’s shares fell as much as 9 per cent on Monday.

Shriram Finance is targeting AUM growth of around 17 per cent-18 per cent for 2025-26, higher than its earlier guidance of 15 per cent, Chakravarti said.

As of March-end, Shriram Finance’s assets under management (AUM) increased by 17 per cent year-on-year and stood at 2.63 trillion rupees ($30.96 billion).

The NBFC is looking to bank on its passenger vehicle and small and medium enterprise loan portfolios to drive its AUM growth, the CEO said, while also exploring new products, such as unsecured business loans and supply chain financing.

Shriram Finance is also looking to deploy the excess liquidity of about 300 billion rupees on its balance sheet, which will help drive net interest margins in the 8.50 per cent-8.80 per cent range for the current financial year, compared with 8.25 per cent in January-March, Chakravarti added.

“Since we are sitting on excess liquidity we will be in a position to actually bargain for an attractive rate. We see our cost of borrowings to trend lower from current levels,” he added.

($1 = 84.9550 Indian rupees)