HONG KONG: Shares of China battery giant CATL soared more than 13 per cent in its Hong Kong debut on Tuesday (May 20) after the company raised US$4.6 billion in what is said to be the world’s biggest initial public offering this year.

A global leader in the sector, CATL produces more than a third of all electric vehicle (EV) batteries sold worldwide.

The firm has been buoyed by a rapid growth in China’s domestic electric vehicle sector, and it now works with major brands including Tesla, Mercedes-Benz, BMW and Volkswagen.

It is already traded in the southern Chinese city of Shenzhen, and its plan for a secondary listing in Hong Kong was announced in December.

In morning trade its Hong Kong shares hit a high of HK$299.80 (US$38.4), up 13.7 per cent from its listing price of HK$263.00.

Founded in 2011 in the eastern Chinese city of Ningde, CATL, or Contemporary Amperex Technology Co Limited, has been aided by strong financial support from Beijing, which has sought in recent years to shore up domestic strength in certain strategic high-tech sectors.

It has also weathered a fierce price war in China’s expansive EV sector that has put smaller firms under huge pressure to compete while remaining financially viable.

HONG KONG IPO

The institutional tranche of the Hong Kong deal was oversubscribed 15.2 times, according to CATL’s filings, while the retail portion was 151 times oversubscribed.

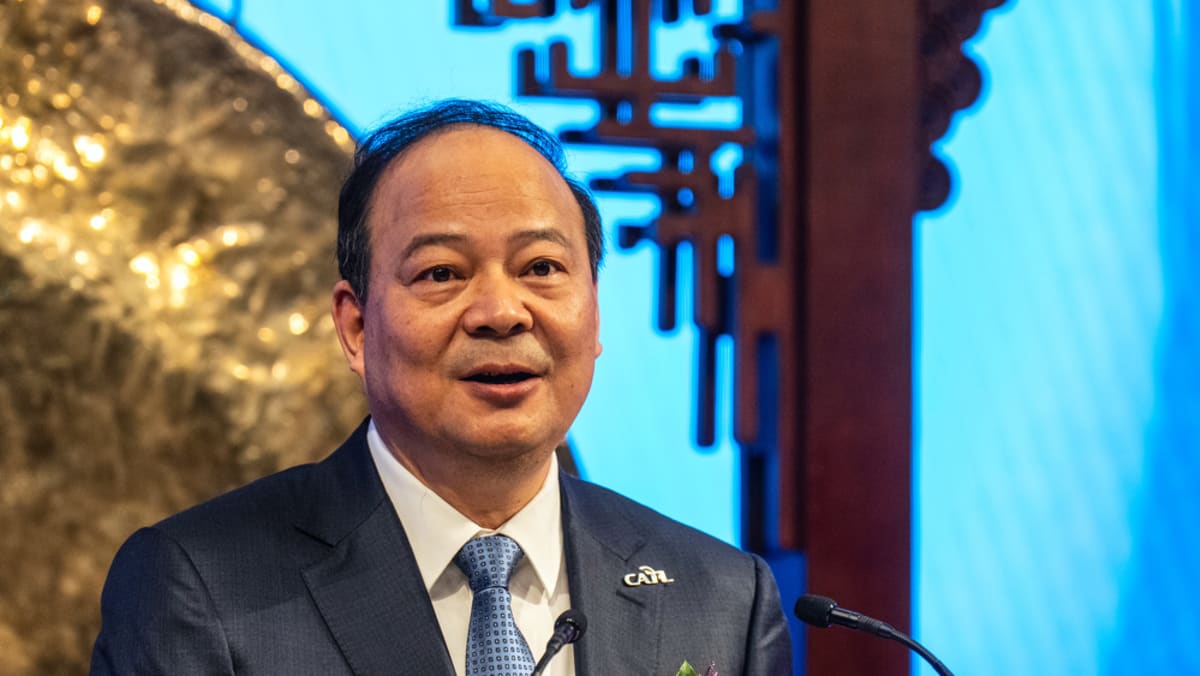

“The Hong Kong stock listing means our wider integration into the global capital market and a new starting point for us to promote the global zero-carbon economy,” CATL founder and chairman Robin Zeng said at a listing ceremony in Hong Kong.

CATL had aimed to raise about US$4 billion in the listing, but increased the size of the deal following the strong demand from investors.

A further 17.7 million can be sold as part of a so-called “green shoe option” that would take the size of CATL’s raising to US$5.3 billion.

At that size, it would be the largest listing in Hong Kong since Kuaishou Technology raised US$6.2 billion in 2021, according to LSEG data.

CATL’s bookbuild had been open for a day when the US and China announced a brief truce in the trade war that had roiled global financial markets since early April.