Automated digital wealth management firm Wealthfront Corporation said on Monday it had confidentially filed for a U.S. initial public offering, as investors show increasing interest in new listings.

The Palo Alto, California-based firm, which did not disclose the terms of the offering, was valued at $1.4 billion in 2022 when its planned acquisition by Swiss bank UBS was scrapped following reported shareholder pushback over the deal’s terms.

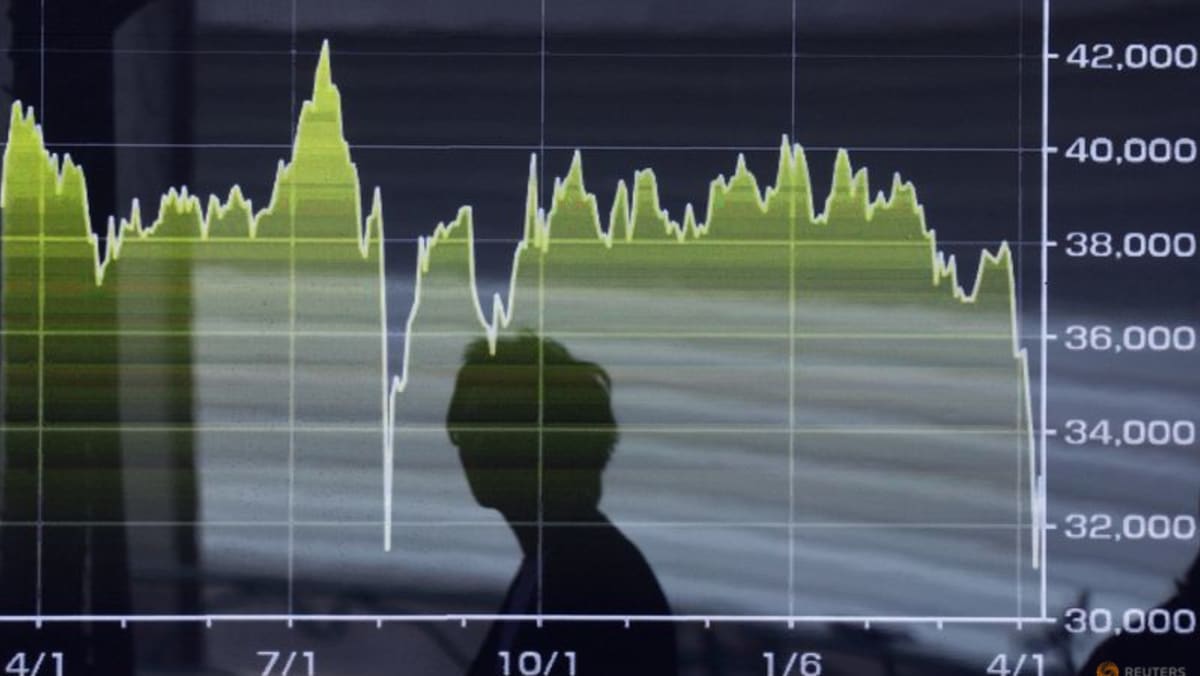

Uncertainty around U.S. President Donald Trump’s tariff policies had prompted companies to put their IPO plans on hold, but investor sentiment has been shifting as new listings gain momentum.

“While there are still concerns over trade policies, tariffs, interest rates and now conflict in the Middle East, the markets seem to have adapted to the age of greater volatility,” said Edward Best, partner at Willkie Farr & Gallagher.

Fintech firms were warmly received in recent months, with digital bank Chime and Israeli trading platform eToro surging in their debut this year.

Meanwhile, Stablecoin issuer Circle’s blockbuster IPO has paved the way for upcoming offerings from crypto exchange Gemini and Swedish fintech Klarna.

“Wealthfront’s IPO plans fit in with the recent uptick of successful U.S. IPOs, particularly from sectors insulated from trade and supply chain volatility,” IPOX research associate Lukas Muehlbauer said.

Wealthfront, founded in 2008 by Andy Rachleff and Dan Carroll, provides automated tools such as cash accounts, ETF and bond investing, trading as well as low-cost loans to its clients.

The company, a pioneer in using automation to build low-cost investment portfolios, has incorporated elements of artificial intelligence into its financial planning software.