SAN FRANCISCO: Intel’s new chief executive is exploring a big change to its contract manufacturing business to win major customers, two people familiar with the matter told Reuters, in a potentially expensive shift from his predecessor’s plans.

If implemented, the new strategy for what Intel calls its “foundry” business would entail no longer marketing certain chipmaking technology, which the company had long developed, to external customers, the people said.

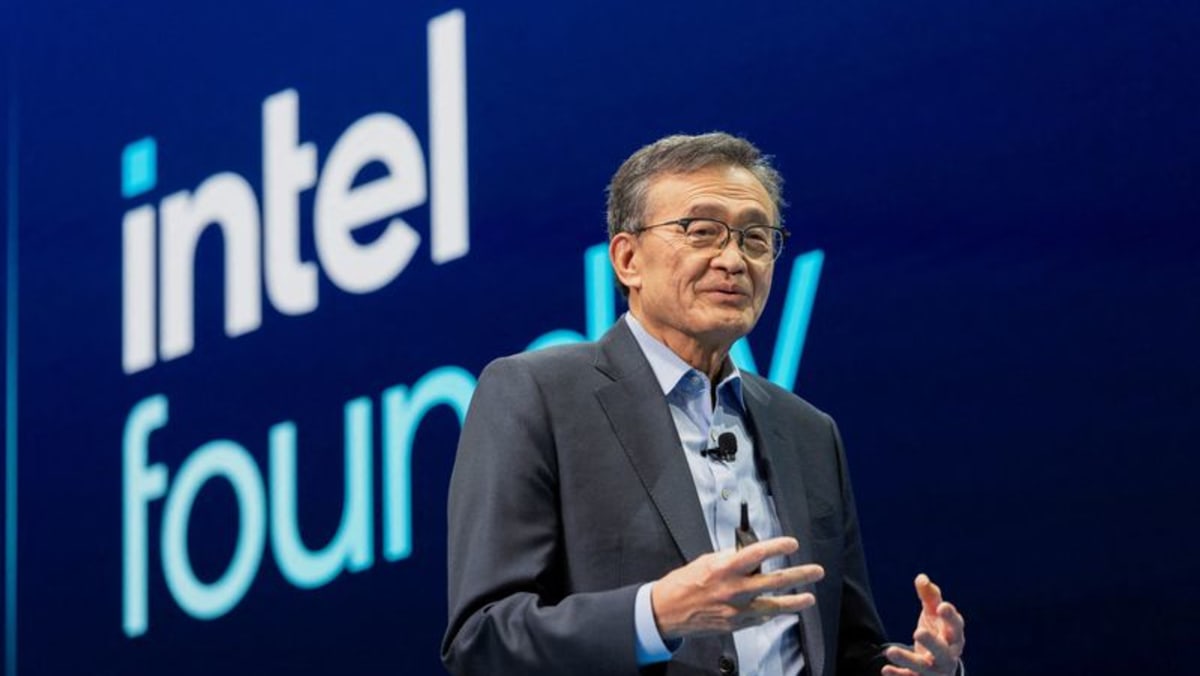

Since taking the company’s helm in March, CEO Lip-Bu Tan has moved fast to cut costs and find a new path to revive the ailing US chipmaker. By June, he started voicing that a manufacturing process that prior CEO Pat Gelsinger bet heavily on, known as 18A, was losing its appeal to new customers, said the sources, who spoke on condition of anonymity.

To put aside external sales of 18A and its variant 18A-P, manufacturing processes that have cost Intel billions of dollars to develop, the company would have to take a write-off, one of the people familiar with the matter said. Industry analysts contacted by Reuters said such a charge could amount to a loss of hundreds of millions, if not billions, of dollars.

Intel declined to comment on such “hypothetical scenarios or market speculation”. It said the lead customer for 18A has long been Intel itself, and it aims to ramp production of its “Panther Lake” laptop chips later in 2025, which it called the most advanced processors ever designed and manufactured in the United States.

Persuading outside clients to use Intel’s factories remains key to its future. As its 18A fabrication process faced delays, rival TSMC’s N2 technology has been on track for production.

Tan’s preliminary answer to this challenge: focus more resources on 14A, a next-generation chipmaking process where Intel expects to have advantages over Taiwan’s TSMC, the two sources said. The move is part of a play for big customers like Apple and Nvidia, which currently pay TSMC to manufacture their chips.

Tan has tasked the company with teeing up options for discussion with Intel’s board when it meets as early as this month, including whether to stop marketing 18A to new clients, one of the two sources said. The board might not reach a decision on 18A until a subsequent autumn meeting in light of the matter’s complexity and the enormous money at stake, the person said.

Intel declined to comment on what it called rumour. In a statement, it said: “Lip-Bu and the executive team are committed to strengthening our roadmap, building trust with our customers, and improving our financial position for the future. We have identified clear areas of focus and will take actions needed to turn the business around.”

Last year was Intel’s first unprofitable year since 1986. It posted a net loss attributable to the company of US$18.8 billion for 2024.

The Intel chief executive’s deliberations show the enormous risks – and costs – under consideration to move the storied U.S. chipmaker back onto solid footing. Like Gelsinger, Tan inherited a company that had lost its manufacturing edge and fell behind on crucial technology waves of the past two decades: mobile computing and artificial intelligence.

The company is targeting high-volume production later this year for 18A with its internal chips, which are widely expected to arrive ahead of external customer orders. Meanwhile, delivering 14A in time to win major contracts is by no means certain, and Intel could choose to stick with its existing plans for 18A, one of the sources said.

Intel is tailoring 14A to key clients’ needs to make it successful, the company said.

AMAZON AND MICROSOFT ON 18A

Tan’s review of whether to focus clients on 14A involves the contract chipmaking portion of Intel, or foundry, which makes chips for external customers.

Regardless of a board decision, Intel will make chips via 18A in cases where its plans are already in motion, the people familiar with the matter said. This includes using 18A for Intel’s in-house chips that it already designed for that manufacturing process, the people said.

Intel also will produce a relatively small volume of chips that it has guaranteed for Amazon.com and Microsoft via 18A, with deadlines that make it unrealistic to wait for the development of 14A.

Amazon and Microsoft did not immediately comment on the matter. Intel said it will deliver on its customer commitments.

Tan’s overall strategy for Intel remains nascent. So far, he has updated his leadership team, bringing in new engineering talent, and he has worked to shrink what he considered bloated and slow-moving middle management.

Shifting away from selling 18A to foundry customers would represent one of his biggest moves yet.

The 18A manufacturing process includes a novel method of delivering energy to chips and a new type of transistor. Together, these enhancements were meant to let Intel match or exceed TSMC’s capabilities, Intel executives have previously said.

However, according to some industry analysts, the 18A process is roughly equivalent to TSMC’s so-called N3 manufacturing technology, which went into high-volume production in late 2022.

If Intel follows Tan’s lead, the company would focus its foundry employees, design partners and new customers on 14A, where it hopes for a better chance to compete against TSMC.

Tan has drawn on extensive contacts and customer relationships built over decades in the chip industry to arrive at his view on 18A, the two sources said.