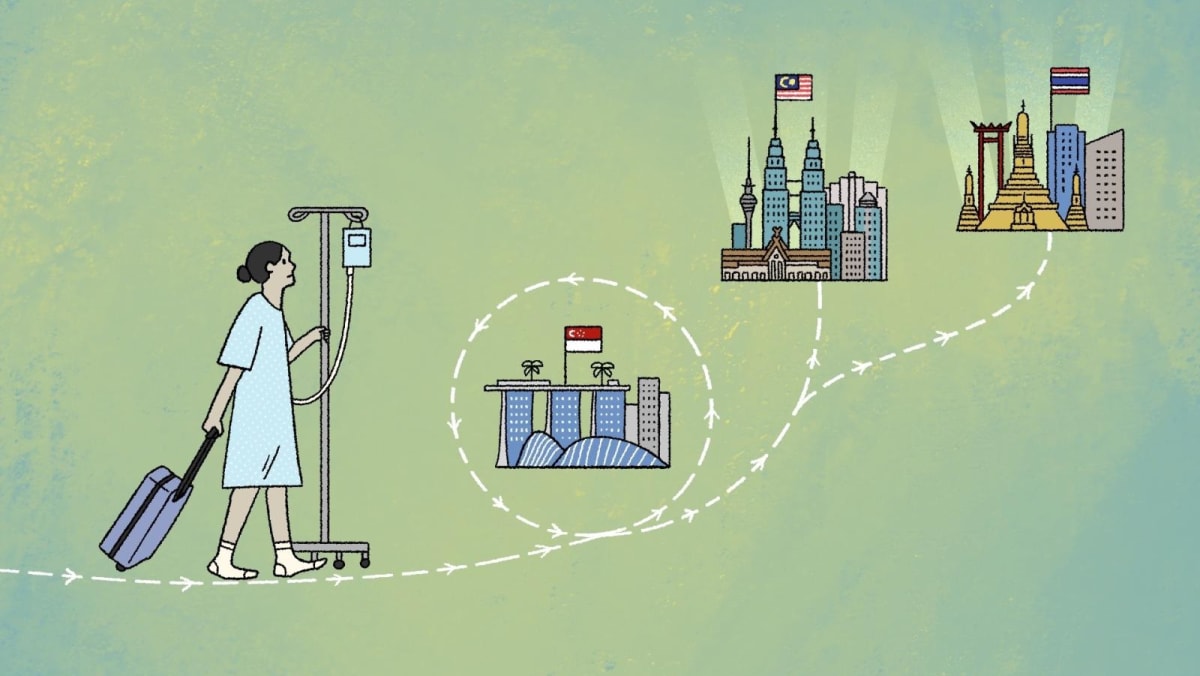

Increasingly, a group of well-heeled tourists are choosing to head to Malaysia or Thailand over Singapore.

They are not drawn to these countries simply because of the shopping or food scenes, but rather, for their cost-effective medical services.

Even though Singapore continues to be named among Asia’s top destinations for medical tourists, it lags behind Thailand, which has long been a popular destination for these tourists in Asia, and Malaysia, which has boosted its medical tourism industry in the past few years.

Others such as Vietnam are also eyeing a slice of the lucrative medical tourism pie, which market research and advisory firm DataHorizzon Research estimates will be worth US$79.4 billion (S$108.5 billion) globally by 2032.

Medical tourists typically travel overseas for services that are not available, too expensive or not of their desired standard in their home country. These can range from simple procedures such as health check-ups to complex treatments such as for cancer or knee stem cell therapy.

In Singapore, medical tourists are mostly from Indonesia, whereas in Thailand, they are typically from the Middle East.

Malaysia, which positions itself as a halal medical care centre for Muslims, draws most of its medical tourists from Indonesia, China and India.

Malaysia is the only country among the three that has a government agency, the Malaysia Healthcare Travel Council (MHTC), backed by its health ministry, that manages the flow of medical tourists.

Singapore does not have a similar coordinating government body overseeing medical tourists, who are typically patients of private healthcare chains.

Thailand does not have one either, but it has made strides to woo such tourists. Last June, the country introduced a new visa category that allows medical tourists to enter Thailand multiple times for up to 180 days.

About 2.86 million medical tourists visited Thailand in 2023, spending US$850 million. RHB bank reported that the number of medical tourists who visited the country in 2024 is expected to be 3.07 million, a roughly 7.3 per cent increase.

Close behind, Malaysia saw growth of about 26 per cent in medical tourists: About 1.26 million such tourists visited the country between January and November last year, up from about a million in 2023.

In contrast, Singapore shifted away from focusing on medical tourism in the 2010s in the midst of scrutiny that public resources were being disproportionately diverted to serve this patient segment.

Since 2015, it has stopped reporting data on the number of incoming medical tourists and their medical spending, but several market watchers have estimated that the country’s medical revenue last year was between S$200 and S$300 million.

Mr Tay Wee Kuang, a senior analyst from financial service firm CGS International, said that the figure could be as high as S$1 billion, based on reported revenue from listed firms IHH Healthcare and Raffles Medical Group.

Both are listed companies that run several hospitals and healthcare facilities in Singapore and around the world. IHH Healthcare has Gleneagles, Mount Elizabeth and Parkway as service providers under its wing, while Raffles Medical Group has a hospital and several clinics under its name.

They and most other private healthcare providers told CNA TODAY that roughly 20 to 30 per cent of their patients are medical tourists. This figure is either slowing in growth or has stagnated over the past five years, they added.

Industry players and analysts said that Singapore’s strong dollar has made medical services costlier for tourists.

This difference is especially pronounced when compared to neighbouring Malaysia and Thailand, where certain services are available at a third of the price.

With medical tourism gaining ground worldwide and analysts foreseeing that it will continue to be a fast-growing sector, is Singapore missing out on a lucrative business?