In veterinary care, Dr Brian Loon, a principal veterinary surgeon at Amber Vet, agreed that competition has gotten stiffer and his team must carefully manage rising costs and not fully pass them on to customers.

“As an independent practice, we can’t access the lower supplier prices that larger groups get through bulk purchasing without compromising the quality of the medications we procure, which inevitably makes our prices higher,” he said.

On the other hand, some vets, such as Dr Arman Chen, veterinary surgeon and practice manager at Gaia Veterinary Centre, said his biggest challenge is not competition from corporations — it is the shortage of manpower, which is an industry-wide problem.

“This has always been the most pressing issue. Even if corporates didn’t exist, the problem would still be the same for us.”

Dr Teo of SVA said the bigger issue for him is not so much the ownership structure or the role of private equity in Singapore’s veterinary sector, but how these developments will impact veterinary professionals and pet owners in the long run.

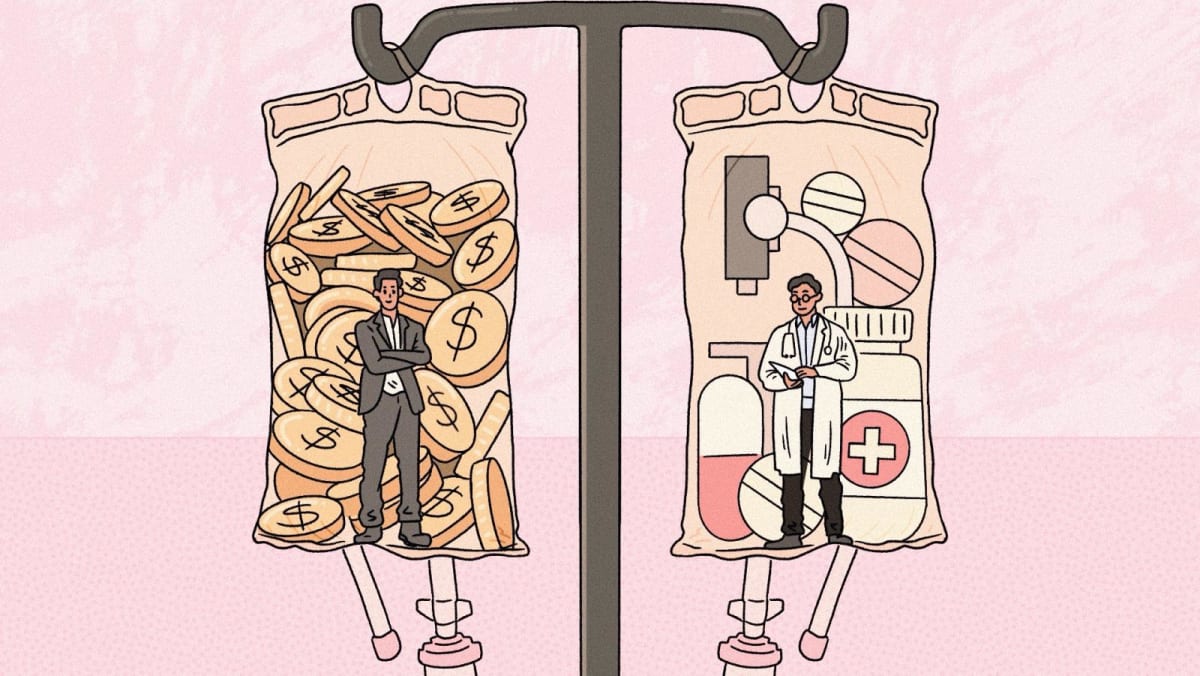

“In human healthcare, there is a public health service to balance private sector activities, along with high insurance uptake and significant government subsidies.

“These are all absent in veterinary care here.”

ADVANTAGES OF PRIVATE EQUITY

CNA TODAY reached out to five private equity firms with known investments in Singapore and Southeast Asia for their response. Most did not respond, while some declined participation.

Experts said despite the downsides, private equity also offers advantages beyond capital.

For example, they could implement a centralised ordering system across a company that has been acquired, potentially resulting in lower prices for consumables due to bulk purchasing. The company could also gain better access to human resources and marketing services.

Ms Chin Wei Jia, group chief executive officer of private healthcare provider HMI Medical, told CNA TODAY that investments from its private capital partners, including private equity, have driven the company’s growth both organically and through acquisitions.

“When speaking with potential investors, we were clear on our criteria. We wanted a partner who truly believes in our mission and vision to support us on our growth journey.

“We wanted a partner with relevant experience in working with quality healthcare providers… (and) a partner who was able to provide us with capital solutions in a timely manner that were aligned with our overall business requirements.”

In recent years, HMI, a family-led business, has averaged two to three acquisitions and partnerships annually. Recent examples include The Harley Street and Vascular Centre, MHC Asia Group, and Advanced Urology Associates.

YCP’s Mr Karkara said private equity firms also bring expertise from other markets, management discipline, and evidence-based decision-making and treatment protocols.

“This adds significant value beyond funding alone. Of course, financial pressures can sometimes lead to suboptimal outcomes, but these issues are recognised and can be managed.”

Mr Karkara added that the advantage for Asian markets, including Singapore, is that they are entering this private equity phase with the benefit of insights gained from challenges already encountered in Western healthcare systems.

“These become ‘known problems’. Consultants like us in private equity take these factors into account. When we recommend changes and support execution, we recognise potential pitfalls and work to prevent them,” he said.

Dr Lim of NUS said it is not unreasonable to want hospitals to be more operationally efficient. In fact, it is the right approach.

The challenge arises when there is insufficient time to make these improvements properly after a healthcare facility is acquired by a private equity.

“For instance, if I’m given 10 years to turn around a hospital, we can implement changes, bring in new systems, adopt technology, without negatively risking patient care.

“But if I only have 12 months, I might have to make quick cuts, like reducing staff or shortening shift hours. This kind of ‘squeeze’ compromises patient care.”

In response to CNA TODAY’s queries about private investment into healthcare, the Ministry of Health (MOH) said Singapore’s healthcare system differs significantly from that of countries like the United States, as it has a significant public sector presence, especially in the hospital and specialist space.

To help consumers make informed healthcare choices, it publishes the bill sizes and fees of public healthcare institutions, along with fee benchmarks for common surgeries in private hospitals and by private doctors.

“There is also a mandatory requirement for all healthcare providers, private or public, to provide financial counselling to their patients,” MOH said.

It added: “MOH also exercises governance over national financing schemes, including MediShield Life and MediSave claims made by private healthcare providers, to ensure claims are appropriate and do not unnecessarily raise healthcare costs and premiums.”

Furthermore, all healthcare providers, regardless of ownership or profit model, must meet stringent licensing requirements, undergo regular audits and follow comprehensive patient care standards.

“MOH will continue to regularly review and update our policies and regulations to address emerging trends in the healthcare sector so that Singaporeans can continue to have access to affordable and good-quality healthcare,” the ministry said.

Dr Tom pointed out that private healthcare, which caters to a different demographic — primarily those willing to pay more than public healthcare patients — can only be sustained with sufficient investment, which is increasingly coming from private equity firms.

“It’s important that not everyone floods into public hospitals, demanding immediate care and overburdening the system.”

Dr Tom also pointed out that doctors have only two pathways to choose, public or private. And those who have worked in public hospitals may eventually choose to work in the private sector, where they can earn more.

“Their income comes from investors, patients, and sometimes international patients, who also contribute to the country by paying taxes. These taxes, in turn, help support public hospitals,” he noted.

“It’s a symbiotic ecosystem. If one system falters, the other will also suffer.”