TOKYO :Nomura Holdings, Japan’s largest investment bank and brokerage, is committed to growing its business in the United States despite recent market volatility, its chief executive said on Friday.

The announcement of sweeping tariffs in April triggered market turbulence and led some investors to sell down U.S. assets as they question U.S. financial dominance and safety.

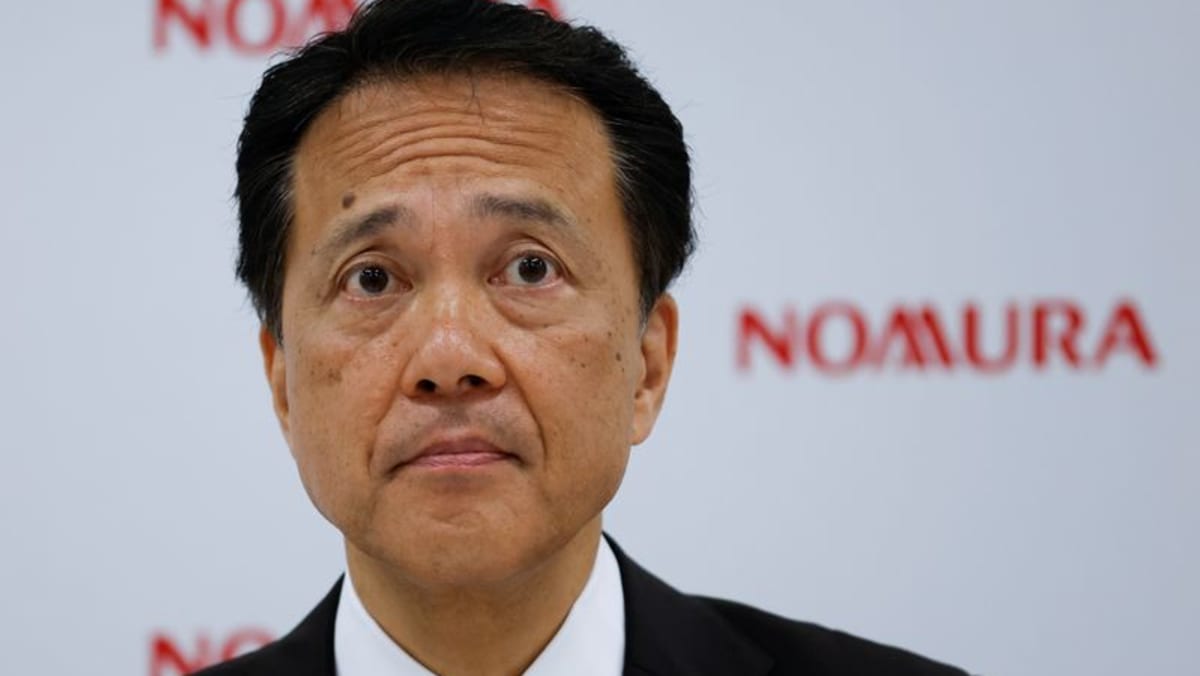

“Although America can be said to be the epicentre of the market volatility surrounding global tariff negotiations, the U.S. is the most important area rich in business opportunities,” CEO Kentaro Okuda said at an investor relations event in Tokyo.

The U.S. market accounted for 14 per cent of Nomura’s income before income taxes in the year ended March 2025, according to an investor relations presentation.

Nomura’s management has long sought to establish the bank as a global player and in April announced the acquisition of Australian Macquarie Group’s U.S. and European public asset management businesses for $1.8 billion – its largest ever.

But some previous acquisitions have had mixed results, such as the purchase of some assets from Lehman Brothers in 2008, which it later wrote down.

While the U.S. market will remain attractive over the long term, Nomura can benefit from any moves away from U.S. assets, Christopher Willcox, head of wholesale and chairman of the asset management division, said at the event.

“We think that the dominance of the U.S. market over the last few years is unhealthy and a rebalancing towards focusing on Europe and Asia is a good thing,” Willcox said.

“We run a global business so that’s fine,” Willcox added.