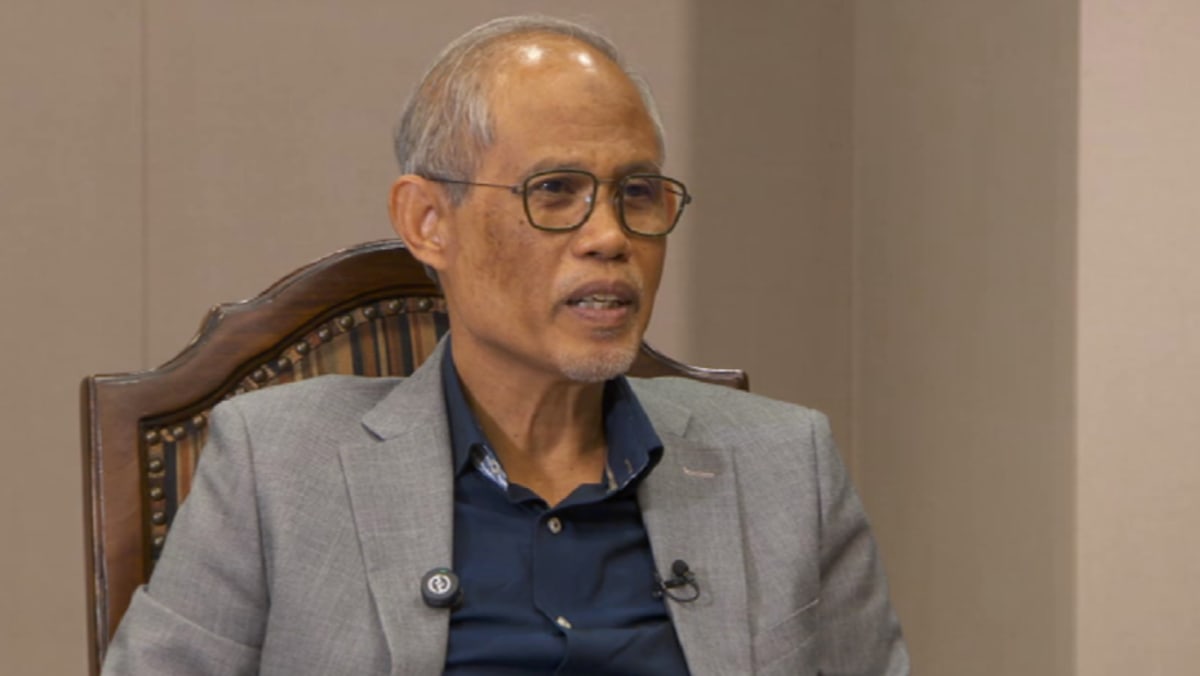

SINGAPORE: Mandating full portability of Integrated Shield Plans (IPs) is not the right solution for the issues faced by policyholders, Minister of State for Health Rahayu Mahzam said in parliament on Tuesday (Nov 12).

Neither is this international best practice, Mdm Rahayu added in response to a parliamentary question by Member of Parliament Tan Wu Meng (PAP-Jurong) who wanted an update on the ministry’s feasibility study.

IPs are offered by private insurers as optional health coverage on top of MediShield Life, Singapore’s national health insurance scheme. This typically covers stays in A- or B1-type wards in public hospitals or in private hospitals.

Various calls have been made for IPs to be made portable, or the ability for policyholders to freely switch health insurers.

The feasibility study, first announced by the Ministry of Health (MOH) in 2021, aimed to address the concerns of policyholders such as those who wish to switch insurers for more competitive premiums or for better benefits, but are unable to do so because of pre-existing conditions.

WHAT’S BEING DONE OVERSEAS

Noting that MOH has studied the issue including arrangements in other countries before arriving at its conclusions, Mdm Rahayu said IP portability is “generally uncommon across the world”.

She noted that it is “usual practice” for insurers to underwrite new policies in order to price the risks of accepting more policyholders with pre-existing conditions into their risk pool.

Underwriting can, however, result in insurers imposing additional conditions on the policyholder’s coverage, such as exclusions to the coverage. Policyholders may also have to pay higher premiums in view of the higher risks.

For countries that allow full portability – policyholders can switch insurers without underwriting – it is “usually a feature limited to their mandatory, national health insurance”, said Mdm Rahayu.

For example in Netherlands or Switzerland, universal coverage is mandated but administered by private insurers. Private insurers are “therefore required to accept any applicant, regardless of whether they are switching from another insurer or uninsured previously”, she added.

“This gives the impression that commercial insurance is portable, but actually it is not, as only the basic coverage under the universal national health insurance scheme is fully portable,” said Mdm Rahayu, adding that these two countries also have supplemental, private insurance that involves underwriting and is not portable.

-2.jpg?itok=dQeiGCso)