MAS said it will hold financial institutions’ boards and senior management accountable for the institutions’ digital advertising activities. Though they may delegate their responsibilities regarding such activities to other parties, their accountability cannot be delegated.

As such, financial institutions “should exercise strong governance and close oversight over their digital advertising activities, including any such activities conducted by their digital marketers”, MAS said.

The central bank added that financial institutions are responsible for all content that they and their digital marketers repost or share, including customer testimonials and third-party endorsements.

“The act of reposting or sharing content constitutes dissemination of an advertisement,” it said.

When selecting digital marketers, financial institutions should also ensure that they have relevant qualifications and understand their target audience.

The marketers should also be kept informed of all updates to financial institutions’ practices and relevant regulatory requirements.

Financial institutions will be expected to monitor and keep track of all their digital advertising activities, including those conducted by external digital marketers, to ensure compliance with regulatory requirements.

Under the guidelines, financial institutions should report any unauthorised advertising to the authorities, such as the police, while customers should be alerted via official channels about such unauthorised activity.

They are also advised to take disciplinary action against digital marketers who commit misconduct or fail to adhere to regulatory requirements.

“Financial institutions should escalate the severity of disciplinary actions meted out against repeat offenders,” said MAS.

“More severe actions, such as suspension or prohibition from digital advertising activities, (strengthen) deterrence against malpractices and errant conduct.”

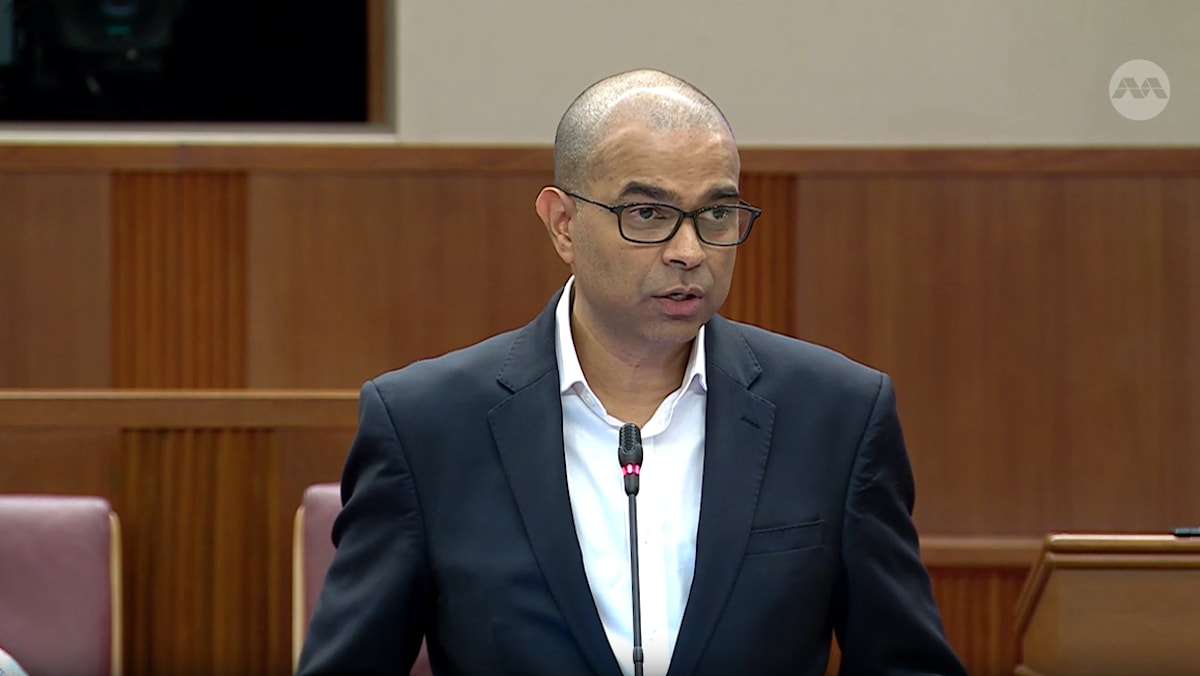

Consumers Association of Singapore president Melvin Yong said that the new guidelines will make it clear that financial institutions and online content creators have the responsibility to ensure that products and content disseminated to consumers are accurate and appropriate.

“When financial institutions and online content creators do the necessary checks and adopt the safeguards in the guide, they in turn protect the interests of consumers. Ultimately, this will go a long way in ensuring consumers are not harmed as they make financial decisions,” he said in a social media post on Thursday.

GUIDE FOR SHARING CONTENT

MAS and ASAS’ guide for content creators is entitled 7 Must-Knows When Sharing Financial Information Online.

According to the guide, some of the key things content creators should consider when sharing financial content include whether they require a licence from MAS to do so, whether entities they are promoting are legitimate, and whether they need to make any disclosures regarding the content.

The guide advises content creators to share financial content responsibly by considering their followers’ financial interests and well-being, and by not exploiting “FOMO”, or the fear of missing out, and inducing panic.

It also says that content creators will not be able to absolve themselves from legal liabilities related to their content by simply saying: “This is not financial advice.”