Here is an excerpt from the conversation:

Andrea Heng, host:

So in the case of Chocolate Finance, at first they paused withdrawals and then they imposed withdrawal limits because there was a surge in people withdrawing funds.

But there can be many reasons why more people want to head to the ATMs and withdraw their money, right? Sometimes it could even be a rumour. So when does it become a serious problem? Because from the consumer’s perspective, I need to know what the signs are to know that this is going to be a bank run and I better get my money out.

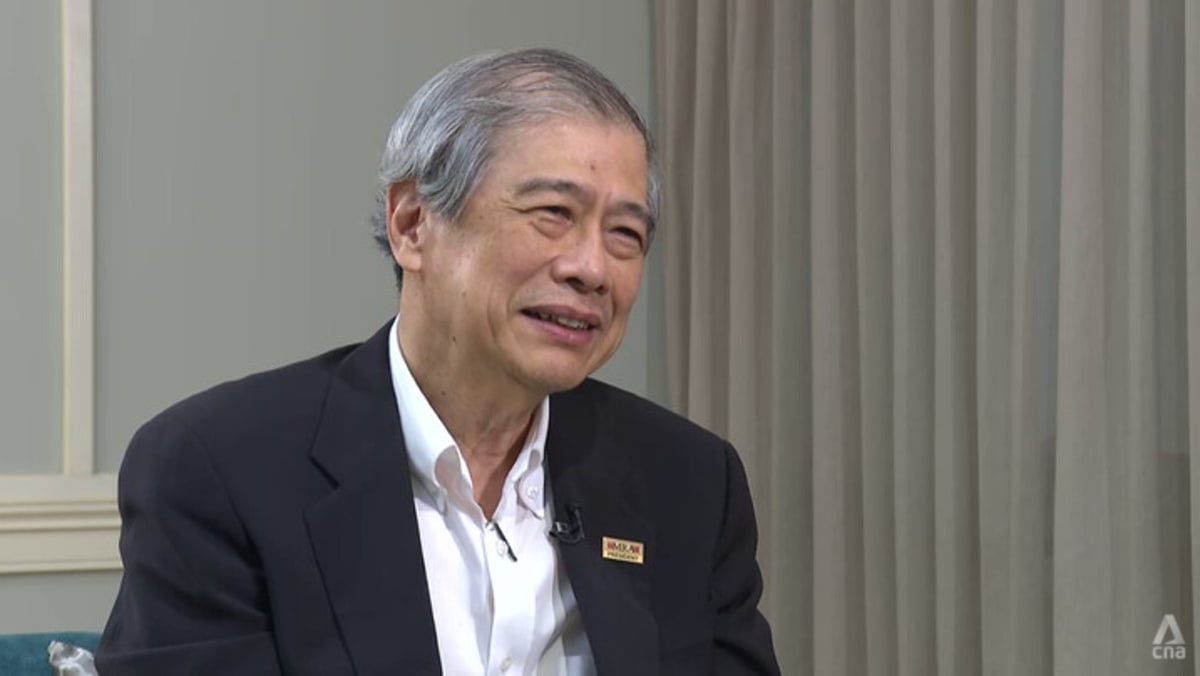

Avishek Nandy, Bain & Company:

So firstly, investment platforms, when they are making certain promises to customers around instant withdrawals (and) rewards etc, they need to have safeguards or reserves in place. So for example, if I am putting in my money in an investment platform that’s investing the money in a money market fund or a fixed income fund, that liquidation of that fund does not happen immediately.

But if (I am) promising that I am going to give (the) customer instant liquidation, I need to have enough reserves in place, because I might take two days to liquidate the fund, but I will pay you meanwhile.