“DO THE RIGHT THING”

Trump late Wednesday called on decision-makers to cut rates now, urging on his Truth Social platform to “do the right thing”.

Kerry Craig, global market strategist at JP Morgan Asset Management, said: “The Fed doesn’t have all the answers but faces plenty of questions about how it is interpreting the shift in the US economy and policy impacts.

“For now, the market seems reassured that the Fed is ready to act if needed.” He added: “Overall, the outlook remains uncertain.”

All three main indexes on Wall Street rallied. Most of Asia followed suit, with Sydney, Seoul, Singapore, Taipei, Wellington and Manila all up.

Jakarta gained almost two per cent to extend Wednesday’s gains, but the index remains under pressure – it has dropped 10 per cent in 2025 – on concerns about Indonesia’s economy, Southeast Asia’s biggest.

Hong Kong, however, retreated after a breathtaking run-up this year that has seen the Hang Seng Index pile on more than 20 per cent. Shanghai also dropped.

Tokyo was closed for a holiday.

The yen extended Wednesday’s gains after Powell’s dovish comments, while the dollar was also softer against the pound and euro.

But lingering tariff fears and geopolitical developments helped safe-haven gold to another record above US$3,056.

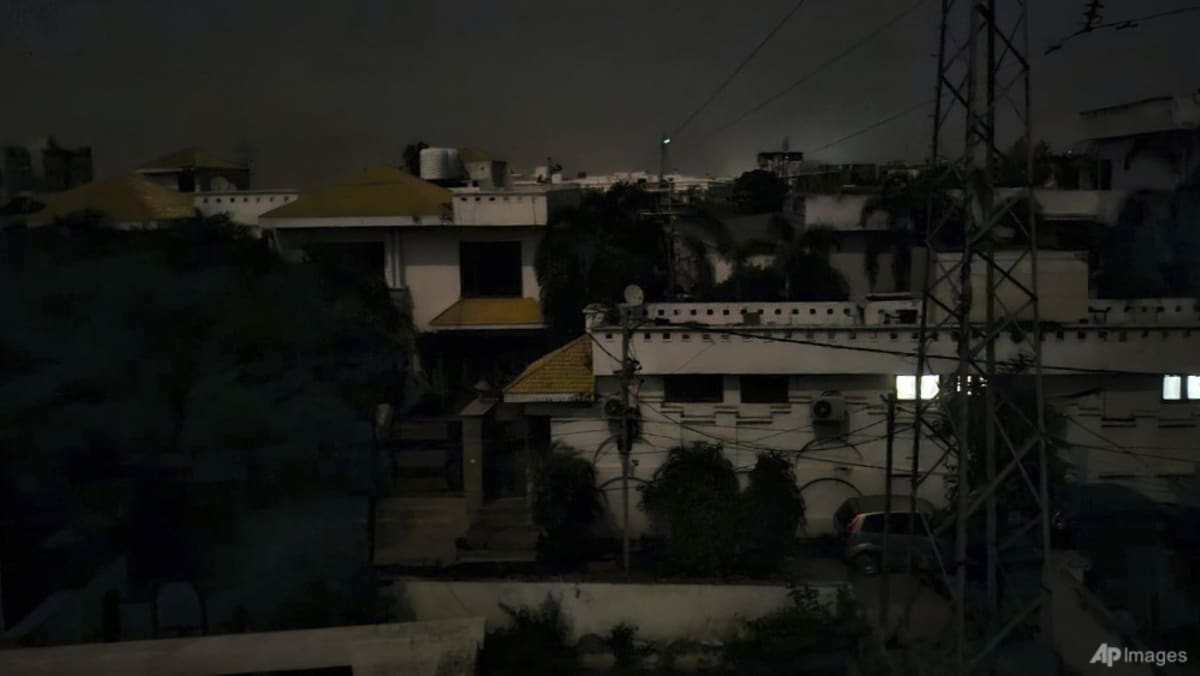

Oil rose again following a fresh upsurge in Middle East hostilities after Israel launched its most intense strikes on Gaza since a ceasefire with Hamas took effect.

Traders are also keeping tabs on eastern Europe after Trump told Ukraine’s President Volodymyr Zelenskyy that the United States could own and run his country’s nuclear power plants as part of his bid to secure a ceasefire with Russia.

Zelenskyy said he was ready to pause attacks on Russia’s energy network and infrastructure, a day after Vladimir Putin agreed to halt similar strikes on Ukraine.