TWO NEW CONDO LAUNCHES DROVE SALES

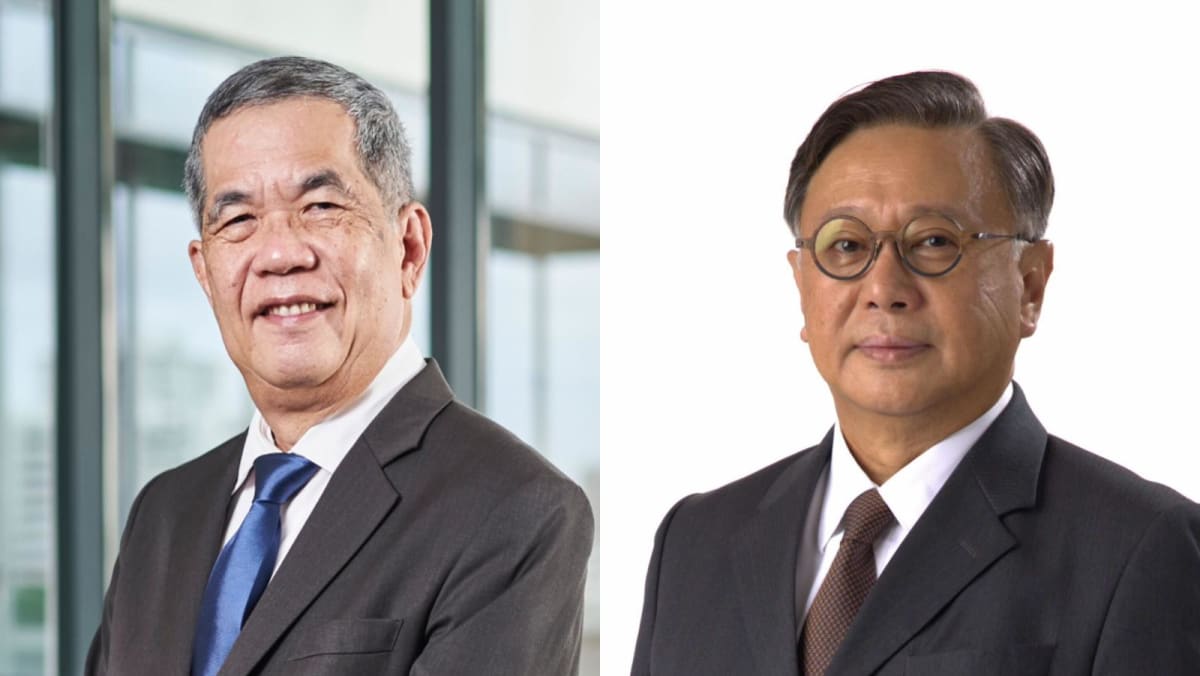

Mr Mohan Sandrasegeran, the head of research and data analytics at Singapore Realtors Inc, noted that the sales figures in February were almost solely driven by the only two new launches last month – Parktown Residence in Tampines and Elta in Clementi.

Both projects “played a pivotal role in sustaining buyer interest and driving the month’s positive sales performance”, he added.

Both Parktown Residence and Elta are located in suburban neighbourhoods which have not seen new supply in at least the past five years, contributing to their “strong pent-up demand and robust take-up”, said Ms Song.

Calling Parktown Residence an “integrated mega-project”, Ms Song noted it sold 1,041 units or 87 per cent of its total units at a median price of S$2,363 psf.

“The key draw for the launch was its unique status as an integrated development with direct access to a host of amenities including a retail mall, the future Tampines North MRT station on the Thomson-East Coast Line, and a bus interchange,” she said.

The project’s stellar launch performance could also have been due to its attractiveness to Tampines HDB upgraders, given its “unparalleled convenience” and combination of nearby amenities and facilities, said CEO of ERA Singapore Marcus Chu.

Elta won over buyers with its proximity to schools and the Clementi town centre, PropNex’s head of research and content Ms Wong Siew Ying said.

It sold about 65 per cent of its units and two-bedroom units were the most popular with 179 units (98 per cent of the available stock) snapped up, Mr Chu said.

PropNex added that this was the best monthly showing for OCR transactions in almost 10 years, when 1,523 units were sold in July 2015.

OUTLOOK

“The primary market started the year brightly, continuing the positive sentiment from end-2024,” Ms Wong said.

However, there is still a long stretch to go and the rest of 2025 is not without downside risks, including “uncertainties in the global economy in view of geopolitical tensions and trade frictions which may be disruptive to growth”, she added.

Ms Song said that the private home sales figures for the first quarter of 2025 are on track to match the 3,420 units sold in the final quarter 2024.

“Sales in March are expected to remain healthy, albeit slowing from February’s high base”, she said, adding that Lentor Central Residences in Upper Thomson reportedly moved over 90 per cent of its units by Mar 9, she said.

Along with Lentor Central Residences, the launches of Aurelle @ Tampines and Aurea, which will be located along Beach Road, will also drive continued buyer interest in March, Mr Sandrasegeran said.

“Given the increased volume of launches in the first quarter of 2025 compared to 1Q 2024, we anticipate a stronger quarter-on-quarter performance, reinforcing market resilience.”

On the second quarter of the year, Mr Sandrasegeran noted that the pipeline of upcoming launches, including Arina East Residences, Marina View Residences, Artisan 8, and One Marina Gardens, is set to “further energise” the property market.

“These projects will introduce fresh opportunities for both homebuyers and investors, adding diversity to the selection of new homes without overwhelming the market with excessive choices.”

Ms Song noted that 2025 should see more private homes sold compared to 2024 due to easing interest rates, better buying sentiment and an attractive pipeline of launches.

But while general take-up rates across new projects are expected to improve, buyers may choose to remain selective in 2025 due to an array of options, she added.

“Attractive developer pricing remains key to healthy new launch performance.”

Private home prices rose by 3.9 per cent in 2024, a moderation from 2023’s 6.8 per cent growth and the 8.6 per cent increase in 2022.

“Home prices are likely to continue rising in 2025 supported by strong household balance sheets, lower interest rates, and potential benchmark pricing at new launches,” said Ms Song.