TOKYO : Japan’s SoftBank Group swung to a 1.18 trillion yen ($7.7 billion) net profit in the three months to September, as the tech giant benefitted from higher share prices of listed companies in its Vision Fund investment vehicles.

The results handsomely beat expectations for a 287 billion yen ($1.87 billion) profit based on the average of four analyst estimates compiled by LSEG, and compares with a loss of 931 billion yen in the same period last year.

The results show SoftBank’s more cautious approach to investment is bearing some fruit. Masayoshi Son’s investing juggernaut was forced into a prolonged period of retrenchment when interest rate hikes caused the value of its holdings in high-growth tech start-ups to crater.

Now some of these valuations are beginning to recover, pushing the Vision Fund unit to an investment gain of 608 billion yen. The unit has been in the black in four of the last five quarters.

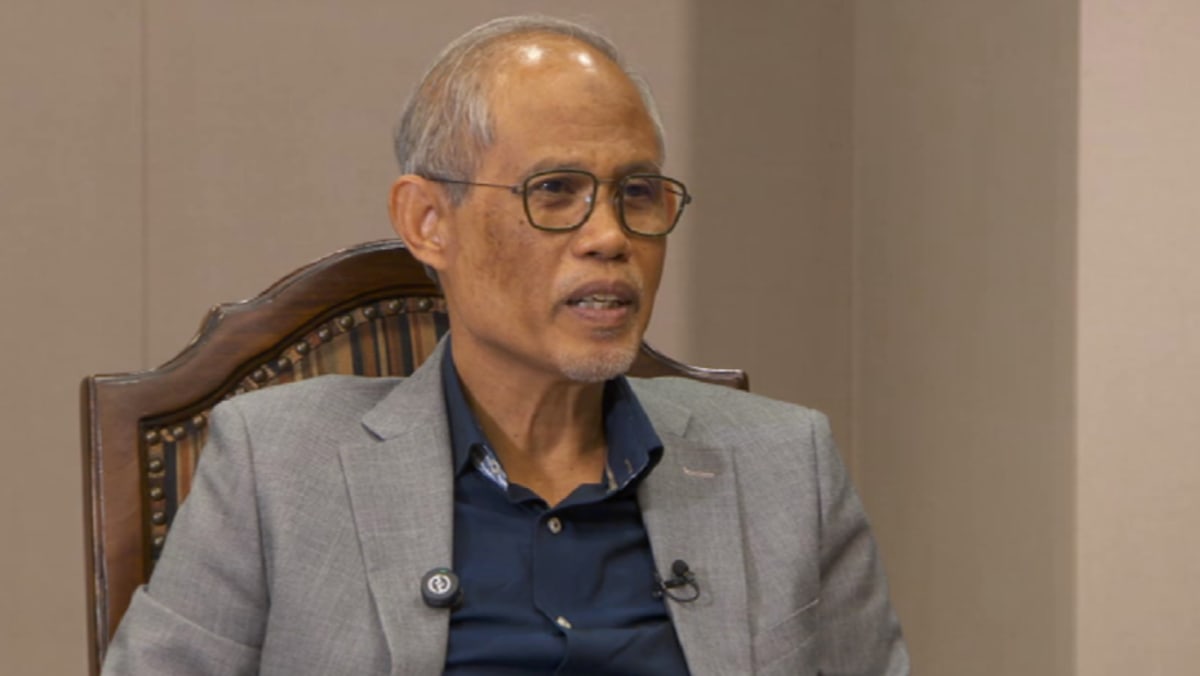

“After we were making large losses in the Vision Funds, we were very conservative. So now we were able to generate good profits as a result of learning from that,” SoftBank Chief Financial Officer Yoshimitsu Goto said after the earnings release.

“Our investment gains were very strong this quarter,” Goto said, adding he has high hopes for companies in its investment portfolio that are at the late stages ready for public listings.

The two Vision funds fully or partially exited investments to the tune of $1.85 billion. It made full exits from 10 portfolio companies including Chinese artificial intelligence firm SenseTime and India’s payment firm PayTm.

SoftBank and its Vision Fund investment vehicles have had few opportunities to monetise holdings amid a muted IPO market in recent years, excepting the blockbuster listing of chip designer Arm in September 2023.

The principal contributors this quarter were Chinese ride hailing giant Didi and South Korean e-commerce company Coupang, which drove an investment gain at Vision Fund 1 to $2.76 billion over the quarter.

Vision Fund 2, which houses a broader roster of early stage tech startups, made a more modest investment gain of $800 million yen for the period, and the group also booked a $2.5 billion investment gain from its stake in T-Mobile.

While Vision Fund 1 has had a gross gain of $22.6 billion since inception this has been largely offset by Vision Fund 2’s $21 billion loss.

A recovery of the yen against the dollar over the quarter generated a gain of 289 billion yen as dollar-denominated liabilities could be funded more readily in yen.

($1 = 153.6400 yen)

($1 = 153.9500 yen)

(This story has been corrected to say that Vision Fund results is for the second quarter, not the first half of the financial year, in paragraphs 9 and 10)