A leadership change could pile pressure on Intel, which is a pillar of US efforts to boost domestic chipmaking. Last year, it secured US$8 billion in subsidies, the largest outlay under the 2022 CHIPS Act, to build new factories in Ohio and other states.

Trump’s intervention marked a rare instance of a US president publicly calling for a CEO’s ouster and sparked debate among investors.

“It would be setting a very unfortunate precedent. You don’t want American presidents dictating who runs companies, but certainly his opinion has merit and weight,” said Phil Blancato, CEO of Ladenburg Thalmann Asset Management.

David Wagner, head of equity and portfolio manager at Intel shareholder Aptus Capital Advisors, said while “many investors likely believe that President Trump has his hand in too many cookie jars, it’s just another signal that he’s very serious about trying to bring business back to the US.”

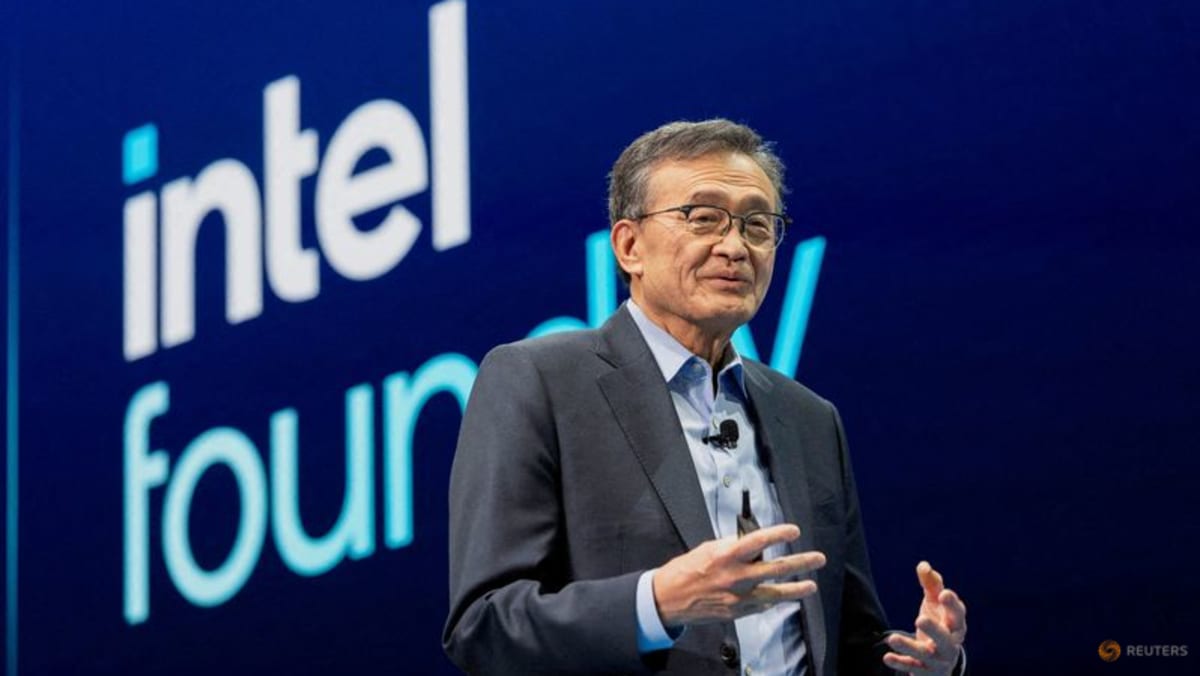

“Intel, The Board of Directors, and Lip-Bu Tan are deeply committed to advancing US national and economic security interests and are making significant investments aligned with the President’s America First agenda,” the company said in a statement on Thursday.

“We look forward to our continued engagement with the Administration.”

Tan, who took over as CEO in March, did not immediately respond to Reuters requests for comment.

Reuters reported in April that Tan himself, and through venture funds he has founded or operates, invested in Chinese firms including contractors and suppliers for the People’s Liberation Army between March 2012 and December 2024.

The reporting was based on a review of Chinese corporate databases cross-referenced with US and analyst lists of firms with connections to the Chinese military.

Reuters identified 20 investment funds and companies where his venture capital firm Walden is currently a joint owner along with Chinese government funds or state-owned enterprises, according to Chinese corporate records.

The government funds were mostly from municipal governments of Chinese tech hubs like Hangzhou, Hefei and Wuxi.

A source familiar with the matter had at the time told Reuters that Tan had divested his positions in entities in China, without providing further details.

Chinese databases reviewed by Reuters at the time had listed many of his investments as current, and Reuters was at the time unable to establish the extent of his divestitures.

Born in Malaysia, raised in Singapore and now a naturalised American citizen, Tan studied physics at Nanyang University, which later merged with the University of Singapore to form the National University of Singapore.

He later went to the US for his formative years of advanced education, studying nuclear engineering at the Massachusetts Institute of Technology.

Tan was the CEO of Cadence Design from 2008 through December 2021, during which the chip design software maker sold products to a Chinese military university believed to be involved in simulating nuclear explosions.

Cadence last month agreed to plead guilty and pay more than US$140 million to resolve the US charges over the sales, which Reuters first reported.

“We don’t believe Lip-Bu is ‘conflicted,’ though given the nature of this administration the China ties are seemingly creating an increasingly bad look,” Bernstein analyst Stacy Rasgon said.

“And unfortunately, unlike other tech CEOs Lip-Bu does not appear to have cultivated the kind of personal relationship with Trump that would help to assuage his ire.”

A White House official said, “President Trump remains fully committed to safeguarding our country’s national and economic security. This includes ensuring iconic American companies in cutting-edge sectors are led by men and women who Americans can trust.”