AMBIGUITIES AROUND EXEMPTIONS

Although Mr Trump indicated that the tariffs would not apply to firms committed to manufacturing in the US, experts said key questions remain about what constitutes a sufficient level of commitment.

“When does it kick in, does ground have to be broken (in the US), how long do you have to build until we know what are the exemptions from these tariffs? We don’t have an answer to that,” said expert on US politics and government Steven Okun, the CEO of sustainability and public affairs consultancy APAC Advisors.

Some jurisdictions have already declared that their companies will be exempt or get favourable tariff rates.

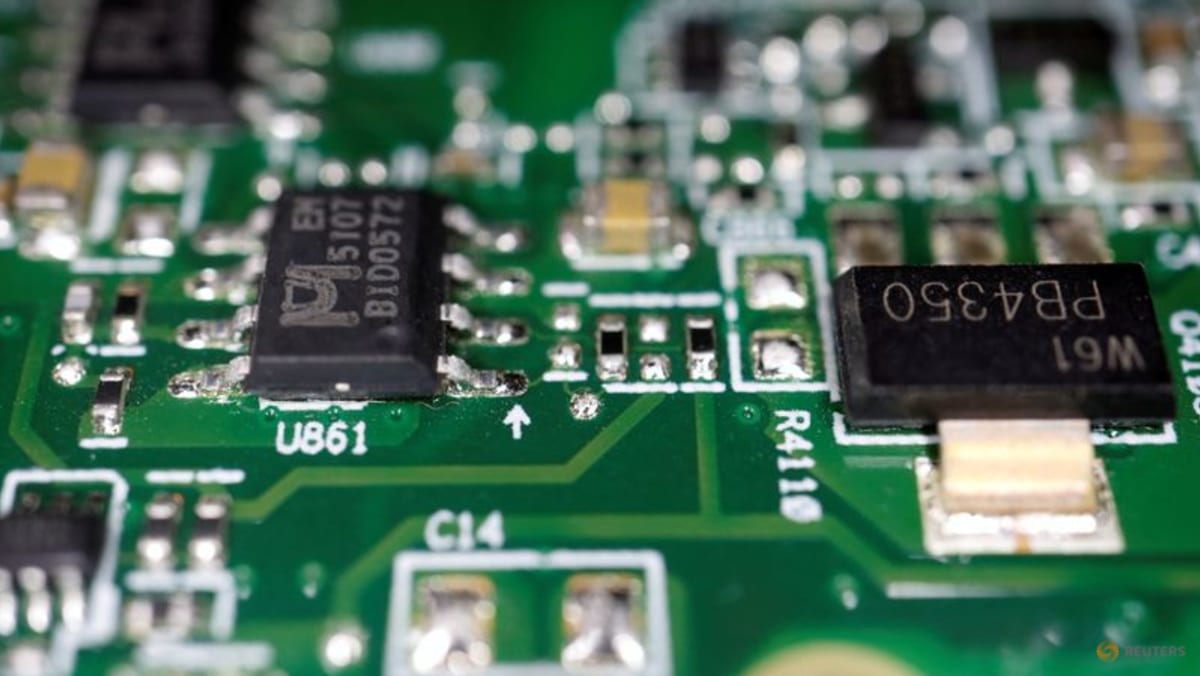

Taiwan’s parliament said chipmaker TSMC would be exempt due to its factories in the US, while a South Korean representative said Samsung Electronics and SK Hynix would also benefit from favourable terms under a trade deal with Washington.

Such exemptions may offer some relief to Singapore-based firms, especially those with US origins or facilities, said Mr Song Seng Wun, economic adviser at financial services provider CGSI.

“It depends on how they define American facilities, and whether or not chip assemblies done in Singapore for American firms are subject to the 100 per cent (tariff),” he said.

He noted that firms like Micron Technology, a US company with offices in Singapore, and GlobalFoundries, which operates in both Singapore and the US, could be affected differently depending on how rules are applied.

Analysts also raised questions around how semiconductors shipped indirectly to the US would be treated.

For example, if a semiconductor manufactured in Singapore is exported first to a neighbouring country to be assembled into an electronic item which is then shipped to the US, it is still not clear if the value of the semiconductor will be tariffed, Mr Okun said.

Mr Song added: “Donald Trump might think it’s quite straightforward, but the supply chain can be quite complex.”