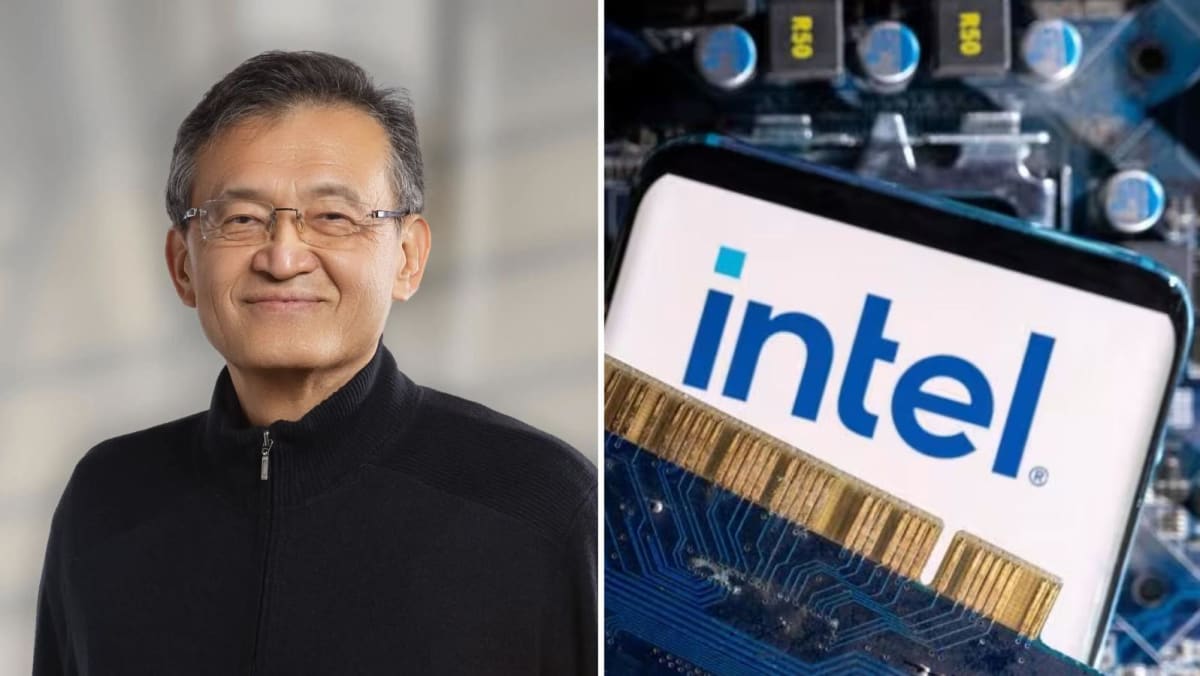

SAN FRANCISCO: Tan Lip-Bu may be one of the most powerful technology executives you’ve never heard of.

As he steps into one of the highest-profile jobs on the planet – CEO of troubled, storied chipmaker Intel – his performance will be on full display.

Tan, named Intel CEO on Wednesday (Mar 12), faces an enormous challenge in turning around the operations of a company that put the “silicon” in Silicon Valley.

While little known to the public, his advantage is that virtually every one of Intel’s former and potential customers knows him and has done business with him, either buying one of the many startups he backed or using software from a company he ran.

Tan rubs shoulders with the likes of Lisa Su from Advanced Micro Devices and Nvidia’s Jensen Huang, two AI chip leaders who, according to Reuters reports, had been pitched to invest in Intel.

His efforts are also likely to be closely watched by US President Donald Trump, who is eager for Intel to rebound.

Tan “can leverage his experience and especially his industry connections, while also pursuing excellence within Intel”, said independent analyst Jack Gold. “Hopefully the board will stay out of his way as he makes needed changes.”

To right the semiconductor industry’s biggest ship, Tan, 65, may use underdog strategies that helped him turn around smaller companies that later became big.

EARLY START

Born in Malaysia, raised in Singapore and now a naturalised American citizen, Tan studied physics at Nanyang Technological University in Singapore.

He later went to the US for his formative years of advanced education, studying nuclear engineering at the Massachusetts Institute of Technology.

He then moved to California for business school and founded venture capital firm Walden International in 1987. That firm, named for the pond where writer Henry David Thoreau sought an unconventional life, made unconventional bets.

Walden International is reported to have managed cumulative capital commitments of $2.8 billion.

INVOLVEMENT WITH STARTUPS

Tan focused on semiconductors, cloud infrastructure, data management and security, as well as artificial intelligence.

He believed that relatively small teams of startup engineers with good chip design ideas could successfully compete against incumbent chip giants, and he poured money into hundreds of startups.

For example, he took a stake in Annapurna Labs, a startup later purchased by Amazon.com for US$370 million that has become the heart of its in-house chip division. Amazon says it now deploys more of its own central processors than it does those from Intel.

He also invested in Nuvia, which Qualcomm bought for US$1.4 billion in 2021, making it a central part of its push to compete with Intel in the laptop and PC chip markets.

Tan remains actively involved with startups that could either become competitors or acquisition targets for Intel.

Earlier this week, for instance, he invested in AI photonic startup Celestial AI, which is backed by Intel rival Advanced Micro Devices.