SINGAPORE: A 27-year-old woman was fined S$18,000 (US$13,400) on Thursday (Mar 27) for fraudulent evasion of Goods and Services Tax (GST) on 17 items acquired during an overseas trip last year.

Investigations revealed that she knowingly failed to declare and pay GST at Changi Airport, Singapore Customs said in a media release on Friday.

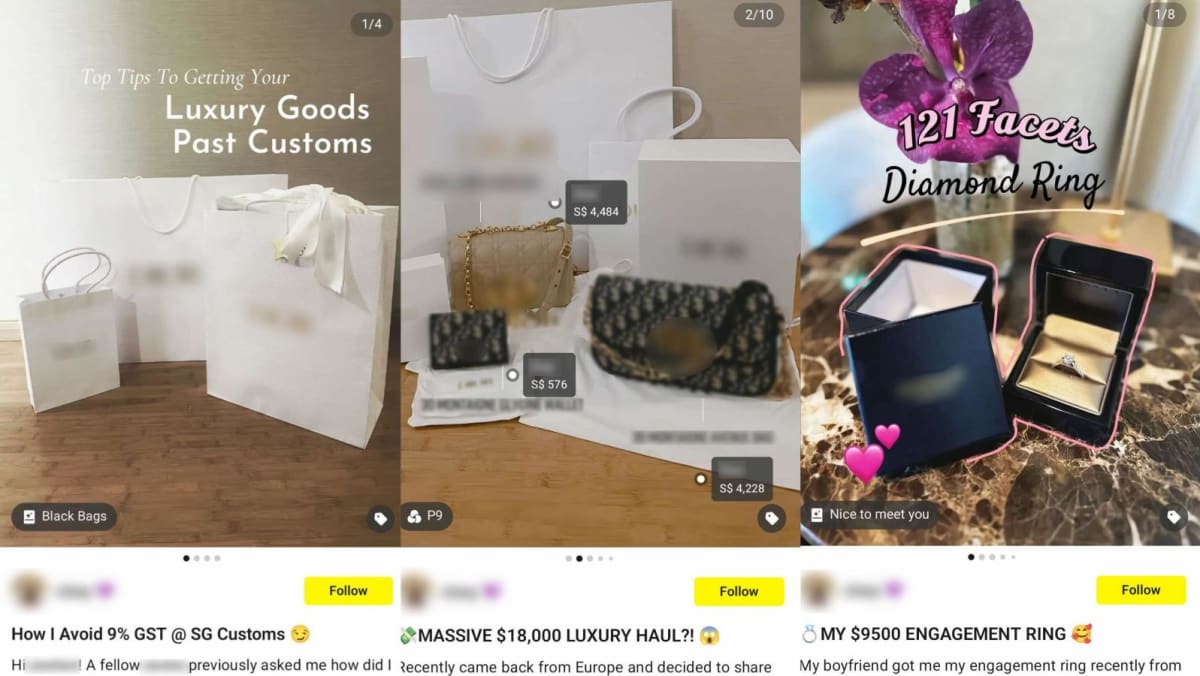

She also took to social media to share about her purchases, including tips on evading GST.

The Singaporean travelled to Europe in May 2024 with her family and boyfriend.

During the holiday, she bought branded bags, wallets, shoes and watches as well as received a diamond ring from her boyfriend, who purchased it during the trip.

When she returned to Singapore, the woman exited the arrival hall via the Green Channel at Changi Airport without declaring these items.

She did so despite knowing that her overseas purchases exceeded her GST import relief entitlement, said Singapore Customs.

“Additionally, she later shared details of her overseas purchases on social media, including methods to evade GST payment.”

Screenshots of her social media posts were shared by Singapore Customs. One of them included a photo of a ring in a box, with the title indicating that it cost S$9,500.

Another post featured white paper bags alongside “top tips to getting your luxury goods past customs” and “how I avoid 9 per cent GST @ SG Customs”.

Following investigations, Singapore Customs arrested and charged the woman with one count of fraudulent evasion of GST.

The total value of her undeclared items amounted to S$25,350.92 after deducting her GST relief. The GST evaded was S$2,281.58, which has since been recovered.

Singapore Customs said evading duties or GST at checkpoints is a serious offence.

“This revenue belongs to Singapore, and its collection is essential to maintaining a level playing field for local businesses that pay these taxes,” it added.

Travellers can declare and pay at checkpoints either in person or through the Customs@SG web application.

Under the Customs Act, anyone found guilty of fraudulent evasion of GST faces a fine of up to 20 times the amount of tax evaded, a jail term of up to two years, or both.