The rush for safety saw gold hit yet another record above US$3,500, and while the dollar steadied after the previous day’s selloff, it remained under pressure against its major peers.

“Gold is the only real safe haven since the dollar has been hit and Treasuries are selling off on a broad pullback from US assets,” said Neil Wilson at Saxo.

Stocks swung between gains and losses on the first full day of business after the Easter break.

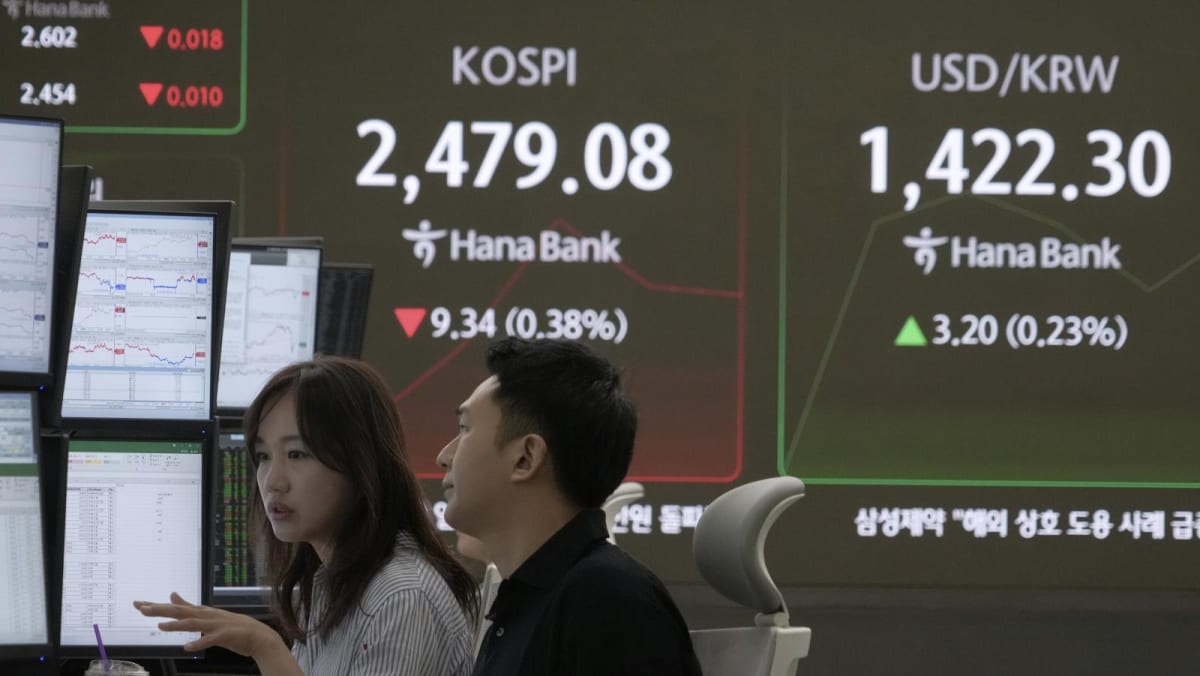

Tokyo, Sydney, Seoul, Wellington, Taipei and Bangkok fell with London, Paris and Frankfurt were in the red.

But Hong Kong, Shanghai, Singapore, Manila, Mumbai and Jakarta rose.

Analysts warned of another rout if Trump were to try to fire the Fed boss, which many said could cause a crisis of confidence in the US economy.

“Were Powell to be fired, the initial reaction would be a huge injection of volatility into financial markets, and the most dramatic rush to the exit from US assets that it is possible to imagine,” said Pepperstone strategist Michael Brown.

“Lower, much lower, equities; Treasuries sold across the board; and, the dollar falling off a cliff.”

“Any sign of the longstanding, independent nature of the Fed coming under threat would see investors across the globe selling every single US-based asset that they have, and also poses the genuinely scary prospect of upending the entire way in which the global financial system operates.”